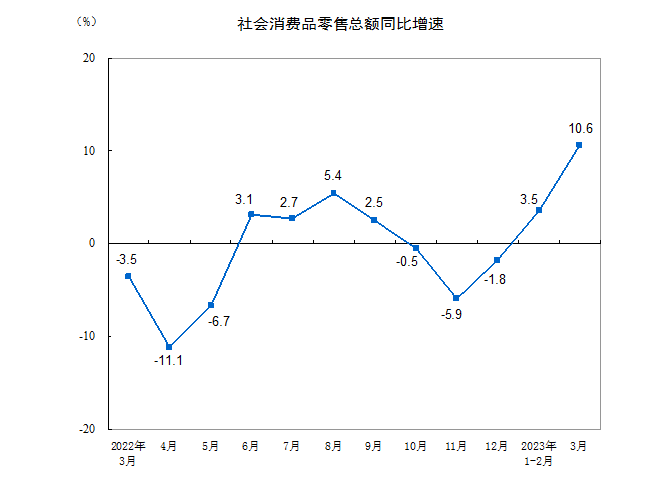

China’s economy grew 4.5% in the first quarter of the year, led by strong recovery in consumption. China’s retail sales expanded 10.6% year on year in March while industrial output grew 3.9%, data from the the National Bureau of Statistics showed on Tuesday. And more Chinese cities saw new home prices growing in March.

Retail sales in the US dipped 1% in March on a monthly basis, data from the Commerce Department on Friday. Unemployment rate rose to 3.8% in Britain in the three months to February according to data from the Office for National Statistics on Tuesday.

Addressing debt crises need reform and innovation and

international organizations should draw on the experience of the private sector for greater efficiency

Global challenges are more wide-spread and deeper than before: new geopolitical tensions, growing debt crisis, slow recovery of the economy, inflation, climate change, energy and food crises, to name a few. How should international organizations promote internal reform to strengthen international cooperation and improve the ability to deal with the challenges? To explore these issues, the International Finance Forum (IFF) and the Bretton Woods Committee (BWC) co-hosted a high-level panel discussion with the theme “The Pivotal Moment for IFIs” on April 11 as part of the IMF/WBG Spring Meetings 2023. It was also the second event of the IFF Washington D.C. Conference.

The speakers and panelists included David Malpass, President, World Bank Group, Kristalina Georgieva, Managing Director, International Monetary Fund, Dr. Xuan Changneng, Deputy Governor of the People's Bank of China, Xian Zhu, Vice President and Secretary General, The International Finance Forum (IFF), Siddharth Tiwari, Senior Advisor to India’s G20 Sherpa and Vice-President, The International Finance Forum (IFF), William Rhodes, Co-Chair, Sovereign Debt Working Group, BWC, Carl Ross, Portfolio Manager and Sovereign Credit Analyst, GMO, Trang Nguyen, Global Head of EM Credit Strategy, BNP Paribas, Richard J. Cooper, Cleary Gottlieb Steen & Hamilton LLP, Mark Walker, Senior Managing Director, Sovereign Advisory Guggenheim Securities, Axel Weber, Co-Chair, Multilateral Reform Working Group, Bretton Woods Committee, Frannie Léautier, Senior Partner and CEO SouthBridge Investments, and Masood Ahmed, President, Center for Global Development, and John Lipsky, Vice-Chair, Bretton Woods Committee, was the moderator.

IMF Managing Director Kristalina Georgieva explained that solving international debt problem was like climbing the mountains. After climbing one hill, there was another one behind it. On one hand, the world was moving from a prolonged period of low-interest rate to a period of higher-interest rate. On the other hand, geopolitical fragmentation and deglobalization was making the landscape even harder to navigate. What’s more, in order to fight the climate crisis, trillions of dollars of investment was necessary. She pointed out that governments and organizations must strengthen international cooperation to pursue structural reform to cope with the above challenges.

World Bank Group President David Malpass remarked that due to the continuous interest rate hikes in advanced countries, developing countries and emerging economies had been facing a sharp increase in the borrowing costs and pressure of repaying debts. Capital flowed to advanced countries, and the shortage of capital was increasingly evident in many parts of the world. Therefore, over the next five years, there had to be an added effort to increase capital supply on the market and boost investment through cooperation and innovation. To solve the problem of the capital flow around the world, just lowering interest rates was not enough and would lead to more inflation. So, one of the big challenges was to find the right solution to this problem.

Concerning the global debt crisis, Dr. Xuan Changneng, Deputy Governor of the People's Bank of China, pointed out that strengthening reform and innovation could help solving the problem. He stated that contractual mechanisms could be very useful to encourage greater participation by private creditors in debt reconstruction. Also, the Collective Action Clauses, or CACs, used in sovereign bonds, proved to be an effective tool for debt reconstruction. Then, there was a great potential for other innovative and flexible ways that private creditors could explore in debt treatment. For example, debt/equity swap allowed developing countries to reduce their debt. This could also help improve corporate governance, which would enable better management practices and lead to better project returns. Thus, it benefited both the private creditors and the debt countries. Lastly, many governments had outlined their climate transition plans, it deepened exploration of ESG bonds. This should receive more attention and become part of the agenda for many countries.

The panelists also offered insights on the World Bank Group reform. Axel Weber, former UBS Chairman and Co-Chair of Multilateral Reform Working Group, Bretton Woods Committee, noted that the current global landscape was undergoing many changes and was faced with new problems at the macro level, which had made global financial governance and decision-making more complex. Multilateral institutions and banks, including the IMF and the World Bank, were actively discussing how to respond to these significant changes and provide timely, effective, and sufficient financial support and solutions. Therefore, he believed that addressing these changes required careful consideration to advance internal structural reforms by the multilateral international institutions.

Mr. Zhu Xian, Vice President and Secretary General of IFF, former Vice President of the New Development Bank, suggested that the World Bank should learn from the private sector to improve operational efficiency and solve the long-standing bureaucratic problems in international organizations. He also stated that in an international institution like the World Bank, different countries could play very different roles due to their respective economic and political strengths. Therefore, the reform of large international institutions was not simply a matter of management, but also a matter of politics and economy. The question was not what to do, but how to do it.

Panelists call for consistent and concerted effort to fight climate crisis at IMF Spring Meeting coorganised by IFF

Panelists urged governments and private sector to join force to address climate crisis in a consistence manner on Monday in a high-level session coorganised by the International Finance Forum (IFF) as part of the International Monetary Fund/World Bank Spring Meetings in Washington D.C..

The meeting, organised by the IFF along with Bretton Woods Committee, the Paulson Insititute, highlighted the urgency of climate action and the need to mobilise governments and private sector for sustainability financing.

Kristalina Georgieva, Managing Director of the IMF, opened by saying the IMF has loaned to five countries under the Resilience and Sustainability Trust (RST) with 44 countries interested in joining. The Trust was established last April to help countries build resilience to external shocks and ensure sustainable growth.

The panel discussion, with experts from public and private sectors, included Li Bo, Deputy Managing Director of the IMF, Jin Liqun, President of the Asian Infrastructure Investment Bank (AIIB), Uzziel Ndagijimana, Minister of Finance and Economic Planning of Rwanda, Deborah Lehr, Vice Chairperson of the Paulson Institute, Vera Songwe, Founder and Chair of Liquidity and Sustainability,and Kenneth Lay, Senior Managing Director of RockCreek Group.

The Resilience and Sustainability Trust was the first long term instrument of the IMF, said Li, which demonstrated the commitment of IMF member countries. But the available funds are insufficient to address climate issues.

"We need urgent action. We need unprecedented global cooperation," urged Li, before adding that the IMF will continue to push the RST so that Climate Change remains top priority for global leaders.

Jin Liqun of the AIIB expressed concerns over a lack of public awareness about the Climate Crisis and a sense of urgency by authorities to mobilise resources to deal with climate issues.

"Unless you do believe this (climate issues) is going to be a crisis looming large on the horizon, it is impossible to mobilize sufficient resources for that purpose," said Jin.

Ndagijimana said governments should equally prioritise climate crisis vis-a-vis Covid 19, with "immediate actions and continuous and consistent measures".

The panel also stressed the importance of collaborations between public and private sectors, Multilateral Development Banks and bilateral donors in climate financing.

Li of the IMF thinks good policy environments and incentives are essential to crowd in the private sector in climate financing. Moreover, the international community should also work together with low and middle income countries to build these countries' capacity in public finance, public investment management and financial management.

Ken Lay of RockCreek suggested that risks in climate projects are holding private funds from pouring into climate financing.

Jin pointed out that regulators should improve policy and regulatory environment to reassure private investors.

Songwe sees carbon pricing and carbon as the next commodity boom when international communities including MDBs work together to deliver data on carbon pricing and wealth will not only go to finance ministries but also local communities.

Former Under-Secretary-General of the United Nations, Former UN Environment Executive Director Erik Solheim visits the International Finance Forum (IFF)

Erik Solheim (third from right) and Hege Araldsen (fourth from left) took a group photo at the IFF Secretariat

On April 16, Erik Solheim, former Under-Secretary-General of the United Nations, former UN Environment Executive Director and former Minister of the Environment and International Development of Norway, together with Hege Araldsen, the Consul General of Norway in Guangzhou, visited IFF Secretariat in Guangzhou. Prof. Song Min, IFF Executive Committee member, Executive Director of the IFF Academic Committee and Dean of the IFF Institute, and Dr. Lu Xuedu, member of the IFF Academic Committee and former Lead Climate Change Specialist of the Asian Development Bank (ADB), participated in the meeting. The both sides exchanged practical ideas of cooperation in promoting sustainable development, global ecological and environmental governance, world peace and development, etc.

Prof. Song Min expressed his gratitude to Solheim for his contributions to promoting global sustainable development and international green financial cooperation as the co-chairman of the Global Green Finance Awards Jury. Through stronger cooperation, IFF can further function as an international financial platform to hold strategic dialogues, pursue information exchanges and cooperation, share innovative ideas and best practices, conduct research, analysis and publication and provide education, talent and other capacity training. In the spirit of “Using Finance to Serve the World”, the IFF would actively promote sustainable development in all aspects. Prof. Song also invited Solheim to the Annual Global Meeting and anniversary events that will hold at the end of this year in Guangzhou.

Solheim said that he is very happy to visit the IFF Secretariat as the world emerges from the pandemic, and he is honored to serve as the co-chairman of the Global Green Finance Awards Jury. He highly praised the important role that the IFF has played in promoting international financial strategic dialogue, exchanges and cooperation, and academic research since its establishment. He also pointed out that the IFF has achieved great international influence. IFF can further strengthen win-win cooperation between countries and support the implementation of the United Nations Sustainable Development Goals on climate crisis, green finance, digital finance, etc.

Dr. Lu Xuedu stated that with Solheim's active participation, high-quality resources worldwide, especially from the EU, can be mobilized to improve the working mechanisms of the IFF and all parties, including the EU, as to promote global economic recovery, and contribute to global sustainable development.

China’s economy expands 4.5% in Q1

The world’s second largest economy grew 4.5% year on year in the first quarter of this year, data from the National Bureau of Statistics showed on Tuesday.

The growth was led by strong recovery in the service sector, which rose 5.4% from the same period last year and grew 3.1% from the fourth quarter in 2022.

Retail sales rose 5.8% in the first quarter, up from a fall of 2.7% in the last quarter of 2022.

Unemployment between age 16 to 24 remained high at 19.6%.

China’s March retail sales grows 10.6%; industrial output rises 3.9%

The world’s second largest economy grew 4.5% year on year in the first quarter of this year, data from the National Bureau of Statistics showed on Tuesday.

The growth was led by strong recovery in the service sector, which rose 5.4% from the same period last year and grew 3.1% from the fourth quarter in 2022.

Retail sales rose 5.8% in the first quarter, up from a fall of 2.7% in the last quarter of 2022.

Unemployment between age 16 to 24 remained high at 19.6%.

More Chinese cities record new home price increase in March

More Chinese cities saw new home prices growing in March, data from the National Bureau of Statistics showed on Saturday.

Of the 70 major cities surveyed by NBS, 64 cities recorded new home prices increases, up by 9 cities from February while 57 cities registered price growth for existing homes, up from 40.

New home prices in China’s first-tier cities edged up 0.3% in March on a monthly basis.

Prices of new homes in second-tier cities grew 0.6%, up from a 0.4% increase a month earlier.

China and Brazil sign cooperation deals

China and Brazil singed bilateral cooperation agreements in areas including trade and economy, science and technology and poverty reduction during Brazilian President’s state visit on Friday.

Chinese President said relations with Brazil is a high priority for China and urged the two sides to deepen cooperation, according to the official Xinhua news agency.

President Luiz Inacio Lula da Silva said deeper and greater cooperation with China will contribute to Brazil’s reindustrialisation efforts, help Brazil address poverty issues.

China’s largest trade fair kicks off first offline event since pandemic

China’s largest trade expo, the China Import and Export Fair, also known as the Canton Fair opened its first in-person expo since the pandemic on Saturday in the southern city Guangzhou.

Participants from more than 200 countries have registered to attend the event, according to state media reports.

China registered robust export growth in March but exports remain uncertain given signs of slowing-down in major economies.

US retail sales fall 1% in March

Retail sales in the US dropped 1% in March on a monthly basis, data from the Commerce Department on Friday, suggesting the economy is slowing down on high interest rates.

Retail sales went up 2.9% year on year.

Total sales in the first quarter of 2023 increased 5.4% from the same period a year ago.

Unemployment edges up in Britain

Unemployment rate rose to 3.8% in Britain in the three months to February according to data from the Office for National Statistics on Tuesday.

The unemployment rate for December 2022 to February 2023 increased 0.1% to 3.8%. The increase was driven by people unemployed for up to six months.

The number of vacancies from January to March fell by 47,000, according to the Office.

G7 to quicken energy transition

Environment and energy ministers of the Group of Seven on Sunday vowed to accelerate transition to renewable energy according to a statement issued by the end of the two-day meetings in the Japanese city Sapporo.

In a communique issued after the meetings, G7 countries called for urgent and enhanced action at all levels to achieve the transformation towards net zero.

The Group said the energy crisis highlighted the urgency to quicken clean energy transition and transform energy systems towards more inclusive, sustainable, clean, secure and affordable ones.

Gender inequalities in food and agriculture cost world $1 trillion, FAO

Closing the gender gap in farm productivity and the wage gap in agricultural employment would “increase global gross domestic product by nearly $1 trillion and reduce the number of food-insecure people by 45 million”, according to a report released by the UN’s Food and Agriculture Organisation on Thursday.

Gender inequalities such as less access for women to knowledge and resources, and a higher unpaid care burden, account for a 24 per cent gap in productivity between women and men farmers on farms of equal size, according to the report.

Women employees in the agricultural sector are paid nearly 20 per cent less than their male counterparts, the report said.

“If we tackle the gender inequalities endemic in agrifood systems and empower women, the world will take a leap forward in addressing the goals of ending poverty and creating a world free from hunger”, said FAO Director-General Qu Dongyu.