HOME>NEWS CENTER>Newsletters

IFF Newsletter Issue 70

TIME:2023-04-06

From the Editor

IFF to organise high-level seminar during World Bank, IMF Spring Meetings

At the invitation of the International Monetary Fund, the International Finance Forum, together with the Bretton Woods Committee and Paulson Institute, will organise a high-level seminar on the global economy on April 10, as part of the 2023 Spring Meetings of the World Bank and the IMF in Washington DC.

Under the theme “Scaling Up Resilience and Sustainability Financing”, the seminar will be moderated by John Lipsky, Vice-Chair of the Bretton Woods Committee.

Managing Director of the IMF Kristalina Georgieva will give opening remarks.

Speakers at the seminar include Deputy Managing Director of the IMF Bo Li, President and Chair of the Board of Directors of AIIB Jin Liqun, Deborah Lehr, Vice Chairperson of the Paulson Institute, Afsaneh Beschloss, CEO of the RockCreek Group, Uzziel Ndagijimana, Minister of Finance and Economic Planning of Rwanda and Vera Songwe, nonresident Senior Fellow of the Brookings Institution.

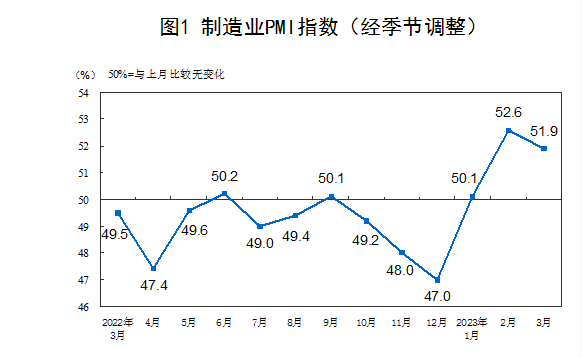

China’s factory activity grew at a slower pace in March, official data showed on Friday.

The official Purchasing Managers’ Index rose to 51.9 in March, down by 0.7 percentage point from February. The 50-mark separates growth from contraction. A reading above 50 shows the expansion of factory activity.

Small and medium-sized enterprises grew at 50.3 and 50.4, down by 1.7% and 0.8% from February.

Sub-indexes of production and new orders also expanded at a slower pace.

The index for employment dropped to 49.7 in March.

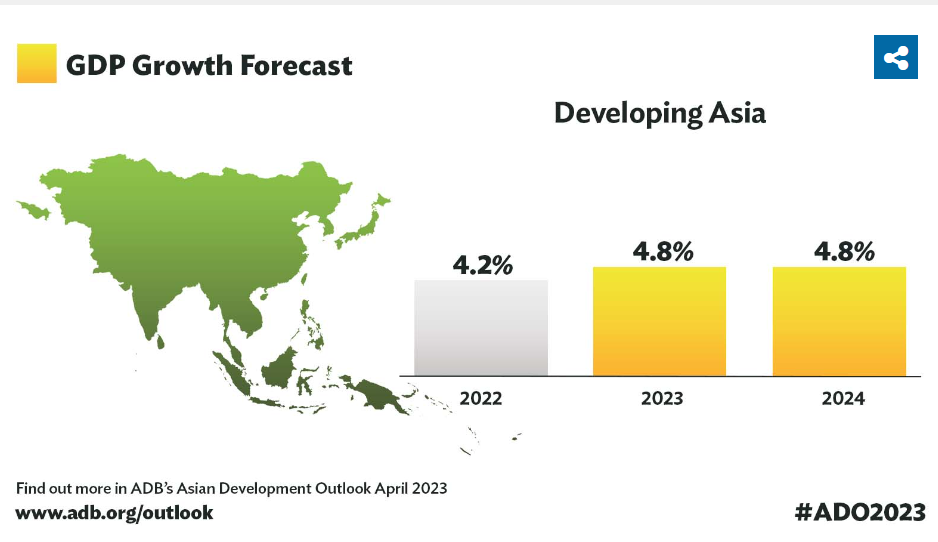

Developing Asia’s economic growth is markedly improving on the rapid reopening of China, said the Asian Development Bank (ADB) in its latest Asian Development Outlook.

China’s reopening will boost regional growth through the demand for goods and services and supply chain linkages, said the bank on Monday.

China’s economy is forecast to grow 5% this year before slowing down to 4.5% in 2023 according to the Outlook while developing Asia is to grow 4.8% in 2023 and 2024.

China’s recovery and healthy domestic demand in India will be the region’s main growth support this year and next, said the bank.

China and Singapore have completed "substantive negotiations" on the upgrade of bilateral free trade agreement (FTA) on Saturday, a day after the two countries agreed to elevate bilateral ties.

China and Singapore elevated bilateral ties to an all-round high-quality future-oriented partnership following the meeting between Chinese President Xi Jinping and Singaporean Prime Minister Lee Hsien Loong on Friday.

China and Singapore signed six agreements on Saturday, deepening cooperation in six areas including food safety, arts and biodiversity conservation.

China, Brazil to trade in local currencies

China and Brazil started to trade in Chinese Yuan and the Brazilian Real,Chinese media reported.

Brazilian ban BBM, based in Salvador and controlled by the Chinese Bank of Communications, had agreed to enter the China Interbank Payment System (CIPS) during the Brazil-China Business Seminar last Thursday.

“A Chinese yuan clearing arrangement between China &Brazil is conducive to cross-border transactions and bilateral trade and investment,” said Mao Ning, spokesperson of the Ministry of Foreign Affairs.

Beijing is to host the Swift International Banker’s Operation Seminar (Sibos) in 2024 according to a joint announcement by the Beijing municipal government and Swift on Monday.

The annual conference is scheduled to run from October 21 to 24 next year at the China National Convention Center.

The forum’s presence in Beijing will be an important milestone in the opening-up of China’s financial industry, said the Beijing Municipal Bureau of Local Financial Regulation and Supervision.

Rising geopolitical tensions and financial fragmentation threatens financial stability by affecting cross-border investment, international payment systems, and asset prices, the International Monetary Fund warned on Wednesday.

Geopolitical tensions, measured by the divergence in countries’ voting behavior in the United Nations General Assembly, can play a big role in cross-border portfolio and bank allocation, said the IMF in its latest Global Financial Stability Report.

According to the IMF, investment funds are particularly sensitive to geopolitical tensions and tend to reduce cross-border allocations notably to countries with a diverging foreign policy outlook.

The organisation called on governments to be aware of the risks to financial stability from geopolitical tensions and manage and mitigate these threats.

The World Bank raises the growth forecast in developing East Asia and the Pacific in 2023 as China reopens.

Growth in developing East Asia and the Pacific is forecast to accelerate to 5.1% in 2023 from 3.5% in 2022, as China's reopening helps the economy rebound to a 5.1% pace from 3% last year.

Growth in the region outside China is anticipated to moderate to 4.9% from the robust post-COVID-19 rebound of 5.8% in 2022, as inflation and elevated household debt in some countries weigh on consumption.

The World Bank added the region’s growth could be held back by slowing global growth, elevated commodity prices, and tightening financial conditions in response to persistent inflation, according to the World Bank’s East Asia and Pacific April 2023 Economic Update.

The UK government have reached an agreement with a major free trade bloc in the Indo-Pacific region.

The UK becomes the first new nation and first European country to join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), a vast free trade area spanning the Indo-Pacific.

“Joining the CPTPP trade bloc puts the UK at the centre of a dynamic and growing group of Pacific economies,” said British Prime Minister Rishi Sunak, “British businesses will now enjoy unparalleled access to markets from Europe to the south Pacific.”

The EU member countries have agreed to raise the renewable target to a minimum of 42.5%, up from the current 32% target.

The EU will aim to reach 45% of renewables by 2030.

The agreement aims to scale up and speed up renewable energy across power generation, industry, buildings and transport.

US President Joe Biden urged banking regulators to restore tighter rules for mid-sized banks, according to a statement by the White House last Thursday.

The weakening of common-sense bank safeguards and supervision during the Trump Administration for large regional banks should be reversed in order to strengthen the banking system and protect American jobs and small businesses, the statement said.

Biden called for a reinstatement of rules of the Obama administration for banks with assets between $100 and $250 billion.

The Biden administration also proposed strong supervision including strengthening supervisory tools, including stress testing, to make sure banks can withstand high-interest rates and other stresses.

UNESCO calls on countries to fully implement its Recommendation on the Ethics of Artificial Intelligence (AI) immediately following calls by over 1000 tech workers this week for a pause in the training of the most powerful AI systems, including Chat GPT.

The framework, endorsed by UNESCO’s 193 member states in 2021, guides countries on how to maximize the benefits of AI and reduce the risks it entails.

Last week, tech CEOs including Elon Musk signed an open letter calling for at least a six-month pause on large, open experiments with AI.