HOME>NEWS CENTER>Newsletters

IFF Newsletter Issue 69

TIME:2023-03-30

From the Editor

Profits of China’s major industrial firms fell 22.9% in the first two months of 2023, data from the National Bureau of Statistics showed on Monday. China will stay open up to the outside world, no matter how the international situation may change, Premier Li Qiang told business leaders of Fortune 500 companies at China Development Forum on Monday. IMF chief sees “green shoots” in China and warns of risks to financial stability.

First Citizens Bank is buying much of the failed Silicon Valley Bank, according to an announcement by the US regulators on Sunday. And the European Union countries on Tuesday passed a law to ban the sales of CO2-emitting cars by 2035.

The IFF continues to bring you the latest China news and global development.

IFF to organise high-level seminar during World Bank, IMF Spring Meetings

At the invitation of the International Monetary Fund, the International Finance Forum, together with the Bretton Woods Committee and Paulson Institute, will organise a high-level seminar on global economy on April 10, as part of the 2023 Spring Meetings of the World Bank and the IMF in Washington DC.

Under the theme “Scaling Up Resilience and Sustainability Financing”, the seminar will be moderated by John Lipsky, Vice-Chair of the Bretton Woods Committee. Speakers at the seminar include Deputy Managing Director of the IMF Bo Li, President and Chair of the Board of Directors of AIIB Jin Liqun, Deborah Lehr, Vice Chairperson of the Paulson Institute and Afsaneh Beschloss, CEO of the RockCreek Group.

Managing Director of the IMF Kristalina Georgieva will give opening remarks.

China will stay open up to the outside world, no matter how the international situation may change, Premier Li Qiang told business leaders of Fortune 500 companies at a development forum on Monday.

He said that China will foster a world-class market-oriented business environment in a meeting with global CEOs during the annual China Development Forum in Beijing.

He told global business leaders that China will accelerate economic reform to achieve higher quality growth.

Earlier on Sunday, China’s Vice Premier Ding Xuexiang said the country will do more to open its markets during a speech at the Forum.

China’s economy is seeing a strong rebound as the economy has reopened and activity has normalised, said the International Monetary Fund (IMF) chief in a speech in Beijing on Sunday in which she also warned of risks to financial stability.

Speaking at the China Development Forum, Kristalina Georgieva, managing director of the IMF, said the robust rebound means China is set to account for around one third of global growth in 2023.

She urged policymakers to stay vigilant as global economy is still faced with high uncertainty.

Profits of China’s major industrial firms fell 22.9% in the first two months of 2023 compared to the same period last year, data from the National Bureau of Statistics showed on Monday.

Asia economy is expected to grow 4.5% this year, according to a report by the Boao Forum for Asia on Tuesday.

China’s Premier Li Qiang will attend the opening ceremony of Boao Forum for Asia Annual Conference 2023 and deliver a keynote speech on Thursday, according to a statement from China’s Ministry of Foreign Affairs.

China's economic recovery and warm weather drive Q1 smog surge

The full recovery of economic activities and unusually warm weather have driven up air pollution levels in the first quarter of this year in China, said the Ministry of Ecology and Environment (MEE) on Tuesday.

The consumption of gasoline and petrol has returned to pre-Covid levels this year and the production of iron and steel, nonferrous metals and coke that are high in pollution emissions has also grown, said Liu Bingjiang, director of the department in charge of air pollution at the MEE.

Liu also pointed out that some local governments blindly carried out projects that are high in energy consumption and emission in the pursuit of economic growth.

Liu said environment protection could also drive economic growth and authorities will curb the blind pursuit of projects that high in energy consumption and emission.

Hong Kong’s government announced a series of measures on Friday to attract family offices as part of its effort to bolster its financial sector.

The measures include a revamped investment migration scheme, tax exemption, market facilitation measures and art storage facilities at Hong Kong International Airport.

"The Policy Statement demonstrates our determination to develop Hong Kong into a leading global family office hub. Developing family office business will be conducive to pool capital from around the world in Hong Kong, bolster our financial market as well as asset and wealth management industry,” said the Financial Secretary Paul Chan.

First Citizens Bank is buying much of the failed Silicon Valley Bank, according to an announcement by the US regulators on Sunday.

The Federal Deposit Insurance Corporation (FDIC) said it has entered into a purchase and assumption agreement for all deposits and loans of Silicon Valley Bridge Bank, National Association by First Citizens Bank in Raleigh, North Carolina.

The Silicon Valley Bridge Bank, National Association was created by the FDIC following the collapse of Silicon Valley Bank.

Bank stocks rallied after the announcement.

The European Union countries on Tuesday passed a law to ban the sales of CO2-emitting cars by 2035.

The agreement was delayed for weeks by Germany, which asked for an exemption for cars running on e-fuels which use synthetic fuels produced with captured carbon.

Germany voted for the law after Brussels agreed on the exemption.

Poland voted against the law while Italy, Bulgaria and Romania abstained.

The United States and Japan have reached an agreement on trade in critical minerals for electric vehicle batteries.

The agreement prohibits the two countries from enacting bilateral export restrictions on critical minerals for EV batteries including lithium, cobalt, nickel, manganese and graphite, Reuters reported.

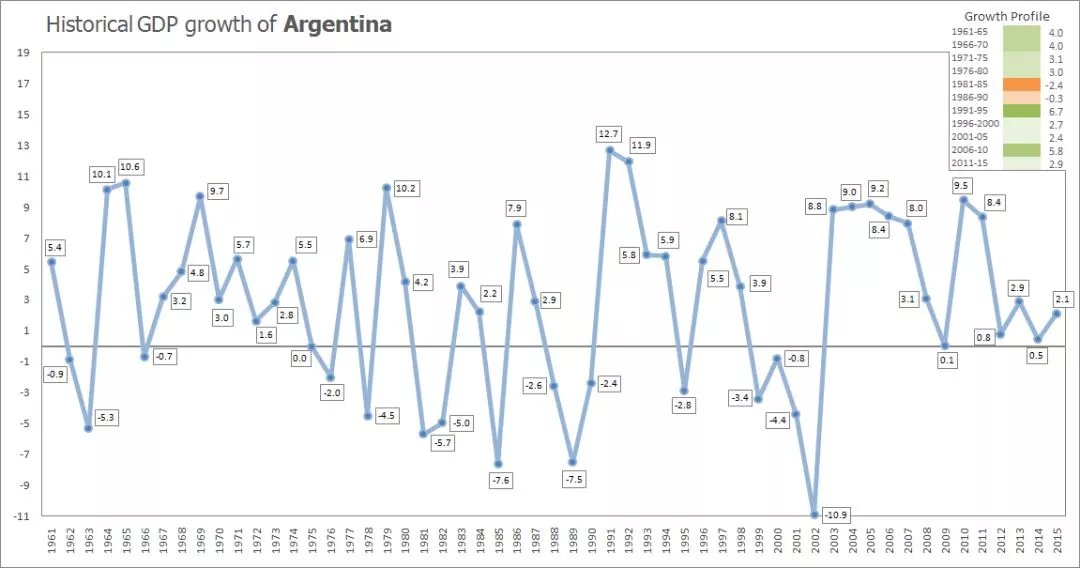

Fitch Ratings has downgraded Argentina’s Long-Term Currency Issuer Default Rating to ‘C’ on Friday, citing an imminent default after authorities asked public sector entities sell or swap their holdings of some sovereign debts.

On March 22, Argentina’s federal government issued two decrees that force public sector bodies to sell or auction five local law dollar bonds and saw six foreign law dollar bonds for peso debt.

The ratings agency said the decrees will affect various types of debt securities.

The country’s rating would be downgraded to ‘Restricted Default’ upon execution of the exchanges, Fitch said in a statement.

The US House of Representatives passed a bill last Thursday to strengthen the partnership between the US and the Association of Southeast Asian Nations (ASEAN).

The bill was authored by Congressman Joaquin Castro and Congresswomen Young Kim.

“Bolstering relations between the United States and the Association of Southeast Asian Nations (ASEAN) is critically important. The U.S. needs to prioritize meaningful economic engagement in the Indo-Pacific region, and enhancing U.S.-ASEAN ties is one of the many steps toward achieving this,”said Charles Freeman, senior vice president for Asia at the U.S. Chamber of Commerce.

The cost of reconstruction and recovery in Ukraine has grown to $411 billion, according to assessment released by the Ukraine government, the World Bank, the European Commission and the United States.

The cost of reconstruction and recovery is expected to stretch over 10 years and combines both needs for public and private funds and the estimate covers the one-year period from Russia’s invasion of Ukraine on February 24, 2022, to the first anniversary of the war on February 24, 2023.