HOME>NEWS CENTER>Newsletters

IFF Newsletter Issue 68

TIME:2023-03-23

From the Editor

More Chinese cities reported rising home prices in February. And China’s fiscal revenues fell 1.2% in the first two months of 2023. To boost economic recovery, China will cut the amount of cash that banks must hold as reserves for the first time this year starting on March 27.

UN’s latest IPCC report urged swift and drastic action to avert irrevocable damage. And the IMF executive board approved a 3 billion bailout plan for Sri Lanka. Global banking sector continues to be under strain after Swiss largest bank agreed to buy troubled rival Credit Suisse and 11 US banks agreed to deposit $30 billion into First Republic.

The IFF continues to bring you the latest China news and global development.

IFF to organise high-level seminar during IMF Spring Meetings

At the invitation of the International Monetary Fund, the International Finance Forum, together with the Bretton Woods Committee and Paulson Institute, will organise a high-level seminar on global economy on April 10, as part of the 2023 Spring Meetings of the World Bank and the IMF in Washington DC.

Under the theme “Scaling Up Resilience and Sustainability Financing”, the seminar will be moderated by John Lipsky, Vice-Chair of the Bretton Woods Committee. Speakers at the seminar include Deputy Managing Director of the IMF Bo Li and Deborah Lehr, Vice Chairperson of the Paulson Institute.

Managing Director of the IMF Kristalina Georgieva will give opening remarks.

Date: Monday, April 10, 2023

Time: 4:00-5:15pm (EDT)

Venue: IMF HQ2 Conference Hall 2

For inquiries, please contact [email protected]

Scan the code to register:

China is to cut the amount of cash that banks must hold as reserves for the first time this year to boost economic recovery.

The People’s Bank of China (PBOC) announced on Friday that it would cut the reserve requirement ration (RRR) by 0.25% for financial institutions from March 27 to keep liquidity ample.

Meanwhile the PBOC announced on Monday that benchmark lending rates will be unchanged for March.

The weighted average RRR for lenders, except those have implemented 5% ratio, will drop to around 7.6%.

More Chinese cities reported rising home prices in February according to official data.

Of the 70 large and medium-sized cities surveyed by the National Bureau of Statistics, 55 reported monthly increases in new home prices, up by 19 from January.

New home prices in China’s four first-tier cities edged up 0.2% in February on a monthly basis while new home prices in second and third-tier cities rose 0.4% and 0.3% respectively from January.

China’s fiscal revenues fell 1.2% in January and February from the same period last year, data from the Ministry of Finance showed on Friday.

Fiscal revenues of the central government fell 4.5% while local government revenues rose 2%.

Tax revenues dropped 3.4% and revenues from land sales fell 29%.

Fiscal expenditure grew 7% to 4.09 trillion yuan in the first two months of the year, official data showed.

China’s foreign trade in goods recorded a surplus of $25.9 billion in February, on par with the same period last year according to the country’s forex regulator.

China’s service trade deficit dropped slightly to $4.3 billion last month, data from the State Administration of Foreign Exchange showed.

China's February rail passenger trips, cargo volume rise

China’s railway passenger trips jumped 43.3% in the twelve months to February to 272.97 million trips, data from the National Railway Administration showed on Tuesday.

Rail freight volume rose 6.8% in February from a year ago to 396.79 million tonnes.

Nearly 809.9 million tonnes of cargo were transported via the railways during the Jan.-Feb. period, up 2.7 percent from the same period last year.

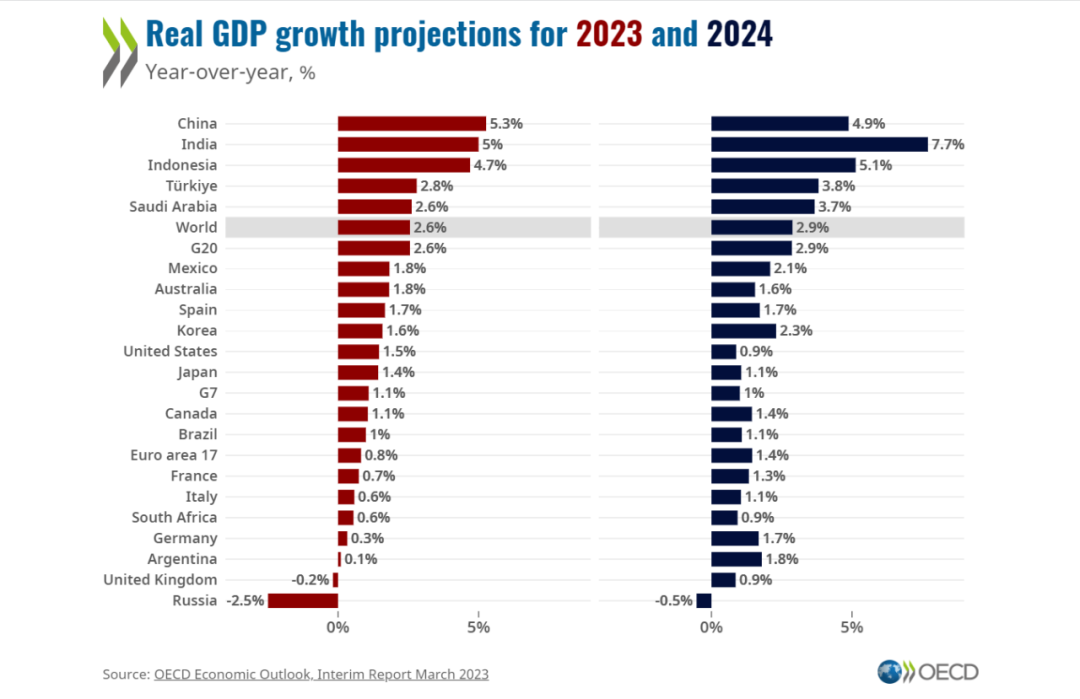

The Organisation for Economic Cooperation and Development (OECD) raised its global growth forecasts on Friday, citing improved business and consumer confidence, declining prices and China’s reopening.

The global economy is to expand 2.6%, up from its November forecast of 2.2%, the OECD said in its interim economic outlook.

In 2024, the world economy will grow 2.9% in 2024, up from its November projection of 2.7%, according the organisation.

Inflation in the Group of 20 major economies would fall to 5.9% this year, down from last year’s 8.1%.