HOME>NEWS CENTER>Newsletters

IFF Newsletter Issue 67

TIME:2023-03-16

From the Editor

China’s new Premier Li Qiang said the country would further support the private sector and create a level playing field for all kinds of business entities . And the country resumed visa issuance of all categories to foreign visitors on Wednesday. China’s new yuan loans rose to 1.81 trillion yuan in February, up by 592.8 billion yuan from last year, central bank data showed on Friday.

It’s been a turbulent week in the American banking sector. Signature Bank, a New York financial institution, closed its doors, two days after the collapse of Silicone Valley Bank (SVB), a California-based lender for technology start-ups. Meanwhile, the US price increase slowed again in February as annualised inflation rate continued to drop in February, data released by the US Bureau of Labour statistics showed on Tuesday. UK’s new budget will support childcare and extend energy bill subsidies.

China will resume issuing visas of all categories to foreign visitors starting from March 15, according to a statement from the Ministry of Foreign Affairs on Tuesday.

The country will resume visa-free entry from Hainan and cruise ships passing through Shanghai.

Visa-free entry for foreign tourist groups to Guangdong will also be resumed.

China’s new yuan loans rose to 1.81 trillion yuan in February, up by 592.8 billion yuan from last year, central bank data showed on Friday.

Total social financing (TSF), a measure of funds that individuals and non-financial firms receive from the financial system, rose 9.9% to 353.97 trillion by the end of February, according to the People’s Bank of China.

The M2, a broad measure of money supply that covers cash in circulation and all deposits, increased 12.9 per cent from last year to 275.52 trillion yuan at the end of February.

Total outstanding yuan deposits stood at 268.2 trillion yuan, up 12.4% from the same period last year.

Mortgage growth slowed in February. Household loans, which were mostly mortgages, rose 208.1 billion yuan, down from January’s increase of 257.2 billion yuan.

Sales of new energy vehicles in February surged 61% from last year to 439,000 units, data from the China Passenger Car Association showed on Friday.

Auto sales in the January-February period fell 15.2% from last year to 3.625 million units, the industry body said.

In February alone, China’s auto sales rose 13.5% from a year earlier to 1.98 million units last month.

China could account for nearly a third of the world’s lithium supply by 2025, Bloomberg reported citing a research note from Swiss bank UBS on Friday.

Production of lithium by Chinese-controlled mines including projects in Africa could reach 705,000 tons by 2025, up from 194,000 tons last year.

That would lift China’s share of the mineral critical to electric-vehicle batteries to 32% of global supply from 24% in 2022, according to the bank.

The Chinese mainland and Hong Kong stock connect programme expanded on Sunday, Chinese media reported.

A statement earlier this month by the Stock Exchange of Hong Kong said 598 stocks will be added to the Shanghai Stock Exchange while 436 stocks will be added to the Shenzhen Stock Exchange.

The expansion brings the total number of stocks eligible for the programme to 1,192 in Shanghai and 1,336 in Shenzhen according to Securities Daily.

Hong Kong Exchanges and Clearing said that eligible shares of international companies primary-listed in Hong Kong would be included in the Southbound trading.

Signature Bank, a New York financial institution, closed its doors, two days after the collapse of Silicone Valley Bank (SVB), a California-based lender for technology start-ups.

The Federal Deposit Insurance Corporation (FDIC) announced on Friday that it has taken over SVB. The bank’s failure was the biggest since the financial crisis in 2008.

Signature Bank was shut down after regulators said that keeping the bank open could threaten the stability of the entire financial system.

US President Joe Biden assured American taxpayers that the price will be paid by those who were responsible, not taxpayers.

HSBC acquired SVB’s UK branch for one pound. And Reuters reported Goldman Sachs was the acquirer of a bond portfolio of SVB which lost $1.8 billion.

US price increase slowed again in February as annualised inflation rate continued to drop in February, data released by the US Bureau of Labour statistics showed on Tuesday.

The Consumer Price Index (CPI) in February rose 6% from a year earlier, down from an annualised rate of 6.4% in January.

Core inflation, which excludes food and energy prices, increased 5.5% last month.

Prices rose 0.4% last month on a seasonally adjusted basis, down from January’s 0.5%.

Climate change could cost Germany up to 900 billion euros by 2050, according to a research paper by the German government.

The paper, conducted by different government research functions said in a best-case scenario climate change could cost 280 billion euros and the costs could go up to 900 billion euros.

The average annual costs of extreme weather events would increase 1.5 to 5 times per year by 2050, which could represent a 0.6% to 1.8% decrease in GDP in 2050.

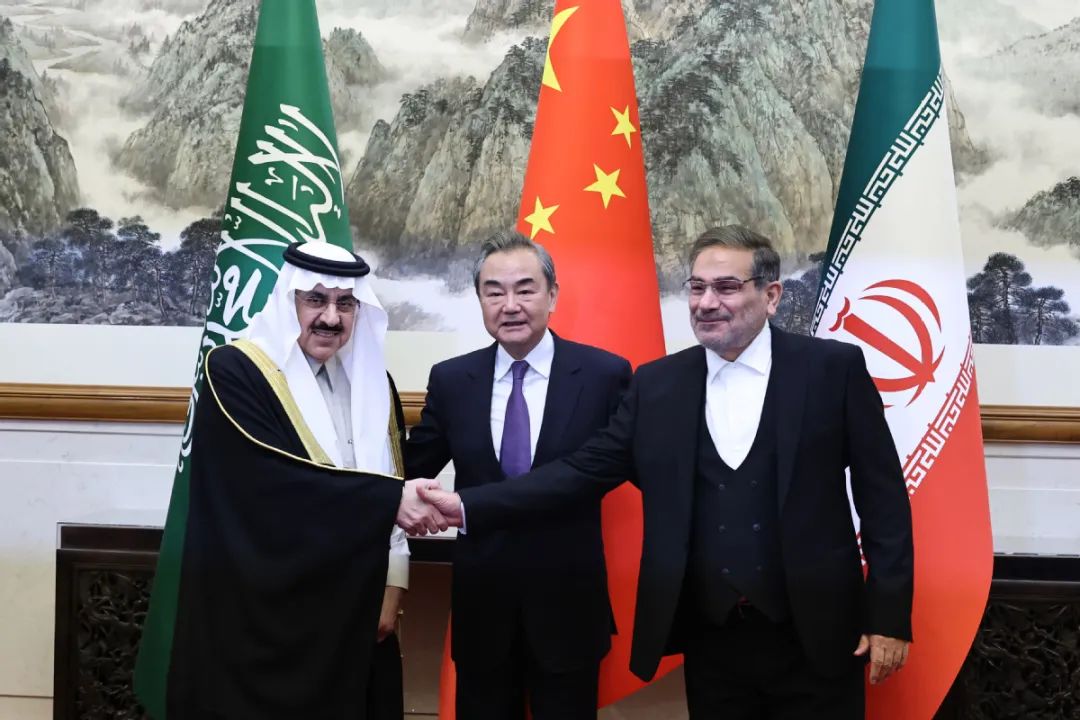

Iran and Saudi Arabia restored diplomatic relations on Friday after China brokered a deal between the two countries.

The two countries agreed to re-open embassies within two months and refrain from interfering in each other’s domestic affairs.

China’s director of the Office of the Foreign Affairs Commission Wang Yi said the improvement of ties between Saudi Arabia and Iran has opened a path leading to regional peace and stability in the Middle East and has set an example of settling divergences and differences among countries via dialogue and consultation.

More than 200 current and former world leaders, Nobel laureates, civil society organisations, faith leaders, and health experts called for vaccine equality to fight against Covid-19 pandemic in an open letter to mark the third anniversary of the pandemic, according to a statement by the People’s Vaccine Alliance.

World leaders urged governments to abandon “ profiteering and nationalism” and prioritise the needs of humanity, according to the statement.