HOME>NEWS CENTER>Newsletters

IFF Newsletter Issue 64

TIME:2023-02-23

China’s securities regulator on Friday issued rules for Chinese companies seeking foreign listings and the country's banking regulator and central bank released draft rules on Saturday to improve commercial banks’ capital and risk management. The southern metropolis Guangzhou invested 200 billion yuan in semiconductors and other high-tech industries.

US existing home sales fell for the 12th consecutive month to the lowest level in more than 12 years. German exports to China dropped 7.1% in January from a year earlier according to official data. And birth rate in South Korea dropped to a new record low in 2022.

The IFF continues to bring you the latest China news and global development.

Theme:Finance and Insurance Serve the High Quality Economic Development of the GBA

Keynote Speaker: ZHOU Yanli, IFF Vice-president and former vice Chairman of the former CIRC

Time: February 24, 2023

To register: https://www.bagevent.com/event/8405985

Theme: One-on-One Global Dialogue on Global Economic Outlook: Challenges and Policy Priorities with IMF

Keynote Speaker: Krishna Srinivasan, Director, Asia and Pacific Department, the IMF

Moderator: Lin Jianhai, Vice President and Chairman of Global Center of the IFF

To register: https://www.bagevent.com/event/8406380

Tutuk Cahyono, Head of Beijing Bank Indonesia Representative Office, visited the International Finance Forum office in Guangzhou and discussed closer cooperation between Indonesian finance sector with the IFF on Wednesday.

Song Min, the Executive Director of the IFF Academic Committee and Dean of the IFF Institute, Zhuang Jue, Deputy Director of the IFF and Liao Xiaosheng, Director of the Nansha Distrcit Finance Bureau of Guagnzhou met with Cahyono and discussed closer collaboration between China and Indonesia, particularly in the Greater Bay Area.

China’s banking regulator and central bank released draft rules on Saturday to improve commercial banks’ capital and risk management.

The China Banking and Insurance Regulatory Commission and the People’s Bank of China jointly released the amended draft rules which will classify banks into three categories based on their business scale or cross-border dealing.

Under the rules, banks with relatively large assets or sizeable cross-border business will be in the first category and under stricter regulations compared to banks in the second and third categories.

The rules will also ask banks to adopt measures for risk assessment.

The draft rules are released to ask for comment and will come into effect on January 1, 2024.

Home prices in China’s 70 major cities rose slightly on a monthly basis, data from the National Bureau of Statics showed.

Of the 70 major cities surveyed, 36 cities saw new home prices rise, up by 21 cities from December while the prices of existing home went up in 13 cities, six more than the previous month.

New home prices in 15 cities went up in the twelve month to January while existing home prices rose in six cities compared to a year earlier.

The People’s Bank of China left its one-year loan prime rate for February unchanged on Monday,

The one-year loan prime rate (LPR) was kept at 3.65% while the five-year LPR, on which many lenders base their mortgage rate, remained unchanged at 4.3%.

The municipal government of Guangzhou allocated 200 billion yuan to two funds to invest in sectors including semi-conductors, renewable energy, bio-medicine and other high-tech industries.

The investment was set up Fund of Funds (FoF). The 150-billion-yuan Industry Investment FoF will focus on semiconductors, renewable energy, and advanced manufacturing etc. The 50-billion-yuan Innovation Investment FoF will establish tech talent transfer fund and angel and seed investment funds to support high-tech and other state-of-art technology industries.

The two FoFs were invested in the Nansha District of the Guangzhou.

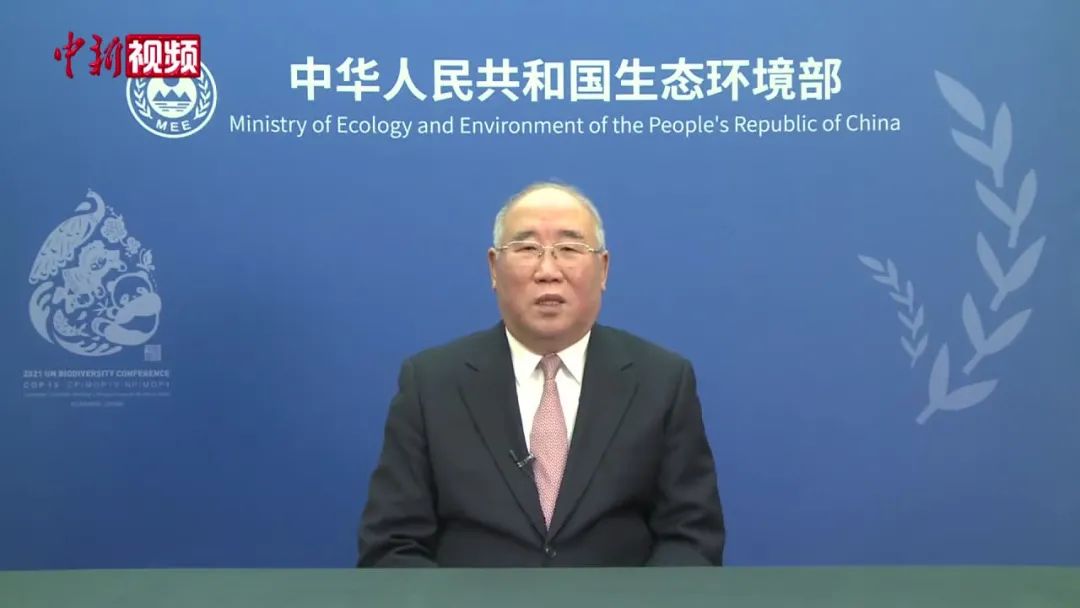

Xie Zhenhua, China's special envoy for climate change, has received an award from the Nobel Sustainability Trust Foundation for his contribution to tackling the global problem and promoting sustainable development, China Daily reported.

In a video address, Xie thanked the foundation for awarding him with the world's highest honor in the area of sustainable development.

US existing home sales fell for the 12th consecutive month to the lowest level in more than 12 years.

Existing US home sales dropped to a seasonally adjusted annual rate of 4 million properties in January, according to data from the National Association of Realtors on Tuesday.

January’s sales dropped by nearly 37% from a year earlier and went down by 0.7% from December.

The median US home price edged up 1.3% in the twelve months to January to $359,000, the slowest annual rate since 2012.

German exports to China dropped 7.1% in January from a year earlier to 7.4 billion euros, data from the federal statistics office showed on Tuesday.

Germany imported 191 billion euros worth of goods from China in 2022. Germany had a trade deficit with China of around 84 billion euros last year, Reuters reported.

New Zealand’s central bank raised its benchmark interest rate by 0.5% to 4.75% on Wednesday.

The Reserve Bank of New Zealand said it expected to keep tightening further to bring inflation to its target range.

The bank said it is too early to assess the monetary policy implications of the recent devastating Cyclone Gabrielle and other severe weather events.

Birth rate in South Korea dropped to a new record low in 2022, data from the Statistics Korea showed on Wednesday.

The average number of expected babies per South Korean woman over her reproductive life fell to 0.78 in 2022, down from 0.81 in 2021, the lowest level since records began in 1970. The fertility rate makes South Korea the only country in the world with a fertility rate below one.

The number of newborns dropped 4.4% last year to 249,000 babies, according to official data.

UN Secretary-General António Guterres called for $500 billion annual stimulus from the Group of 20 to meet the UN’s sustainable development goals.

“The high cost of debt and increasing risks of debt distress demand decisive action to makeat least $500 billion dollars available annually to developing countries and convert short term lending into long term debt at lower interest rates,” said Guterres.