HOME>NEWS CENTER>Newsletters

IFF Newsletter Issue 95

TIME:2023-09-29

From the Editor

China’s central bank will implement monetary policy in a “precise and forceful” manner to support economic recovery, the People’s Bank of China (PBOC) said in a statement on Wednesday. Profits of China’s industrial firms in August surged 17.2% from a year earlier, official data showed. Some Chinese companies have obtained export licenses for gallium and germanium, materials used to produce chips.

US consumer confidence fell to a four-month low in September. President of the European Central Bank Christine Lagarde said the interest rates will remain high “as long as necessary” to curb inflation. And Japan’s Prime Minister Fumio Kishida unveiled a new economic stimulus package which aims to reduce the impact of inflation on households and raise wages.

For those who are celebrating, the IFF wishes you a very Happy Mid-Autumn Festival!

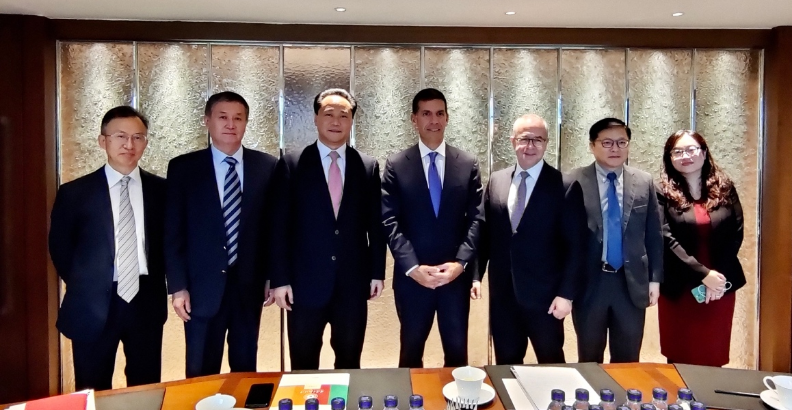

Goldman Sachs President meets with IFF to discuss deepening China-US Green Finance cooperation

President and Chief Operating Officer of the Goldman Sachs Group John Waldron met with the the International Finance Forum in Beijing on Monday to discuss how to deepen cooperation between China and the US in green fiance and accelerate the transition to a low-carbon economy.

The two sides talked about the latest work and development of the Green Finance Working Group (GFWG) which was jointly launched by the Goldman Sachs, the Paulson Institute and the IFF in 2021.

The Goldman Sachs and the IFF agreed that the GFWG will organise more meetings for the management teams of its member companies and continue to research on green finance in the two countries and best practices, the result of which will be published in the GFWG White Paper.

Both sides agreed to deepen collaboration in green finance and build a better platform for U.S., Chinese as well as other global companies to exchange and develop ideas on green finance innovation and the transition to a low-carbon economy.

Kevin Sneader, President of Asia Pacific Ex-Japan of the Goldman Sachs also joined discussion.

China’s central bank vows to use ‘precise, forceful’ policy to bolster recovery

China’s central bank will implement monetary policy in a “precise and forceful” manner to support economic recovery, the People’s Bank of China (PBOC) said in a statement on Wednesday.

The PBOC said it will provide continuous support and intensify the strength of macro-economic regulation and implement a prudent monetary policy in a “precise and forceful” manner.

It will guide banks to lower borrowing costs for companies and households and support banks to replenish capital.

It also vowed to promote the healthy and stable development of the property market, implementing policies to lower down payment ratios and mortgages rates for home buyers.

China grants export licenses for chip materials gallium, germanium

Some Chinese companies have obtained export licenses for gallium and germanium, materials used to produce chips.

Spokesperson for the commerce ministry He Yadong said that the ministry has approved applications from some companies that comply with relevant regulations.

He said the ministry will continue to review other license applications and make decisions in accordance with legal procedures.

China’s commerce ministry and the General Administration of Customs imposed export restrictions on industrial materials containing gallium and germanium in july, which took effect from August 1.

China’s industrial profits surge in August

Profits of China’s industrial firms in August surged 17.2% from a year earlier, data from the National Bureau of Statistics showed on Wednesday.

It was a strong rebound after profits fell 6.7% and 8.3% in July and June respectively.

Profits fell 11.7% in the first eight months of the year, narrower than the 15.5% contraction for the first seven months.

EU trade commissioner Valdis Dombrovskis visited China for the 10th China-EU High-level Economic and Trade Dialogue.

A statement from the commerce ministry said the countervailing measures proposed by the EU side is a protectionist act that will affect China-EU green cooperation and the stability of the global automotive industry.

The European Commission announced earlier this month that it would investigate whether to impose tariffs to shield European car manufacturers from cheaper Chinese electric vehicle (EV) imports which the EU said benefited from state subsidies.

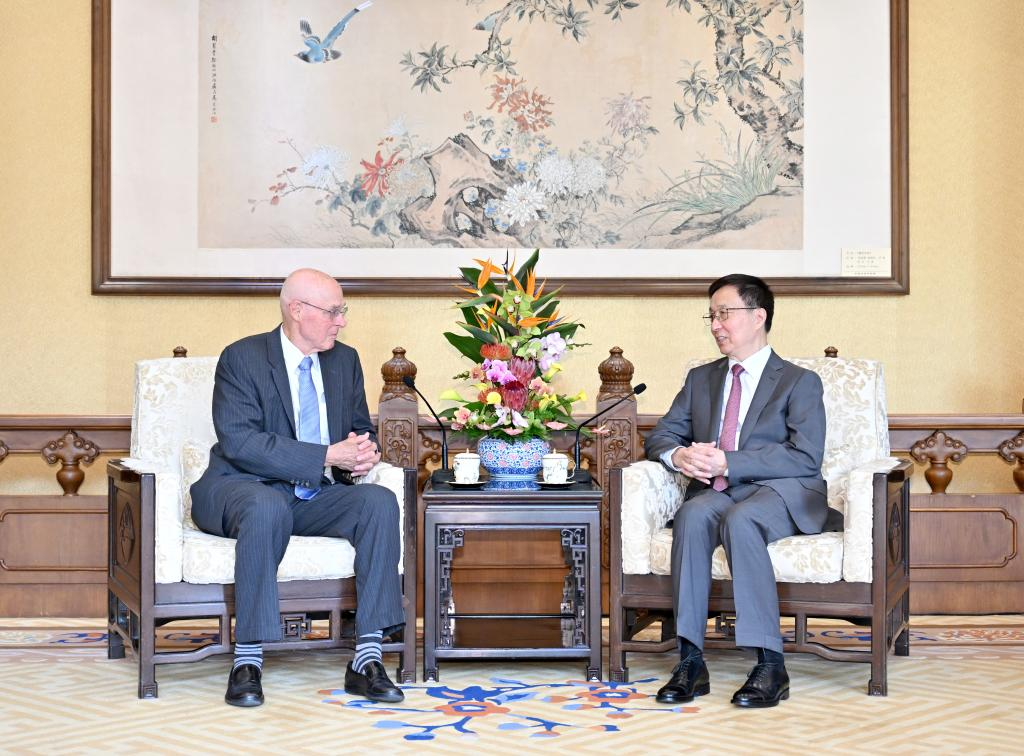

China welcomes more U.S. companies to invest and do business in China to share development opportunities, said China’s Vice President Han Zheng during a meeting with former U.S. Treasury Secretary Henry Paulson.

Han expressed hope for the two countries to work together to bring the bilateral ties back to the track of sound and steady growth.

China’s foreign minister Wang Yi also met with the delegation led by Paulson.

China will take steps to boost consumption for the upcoming Mid-Autumn and National Day holiday which lasts from September 29 to October 6.

The commerce ministry said it will launch a wide range of promotional activities and innovate consumption scenarios.

Spokesperson He Yadong said the country is also planning to release a slew of measure to boost the market for car components and accessories.

Newsletter

International News

US consumer confidence fell to a four-month low in September, data from the Conference Board showed on Tuesday.

The Consumer Confidence Index dropped to 103, the lowest since May, down from an upwardly revised 108.7 in August.

“Consumer confidence fell again in September 2023, marking two consecutive months of decline,” said Dana Peterson, Chief Economist of the Conference Board.

She said the declines showed that consumers continued to be concerned over rising prices in general, particularly for groceries and gasoline.

President of the European Central Bank (ECB) Christine Lagarde said on Monday the interest rates will remain high “as long as necessary” to curb inflation.

The ECB raised its key interest rate to a historical high of 4% in September.

Lagarde said rates would stay high as prices remain elevated across the euro area.

Speaking at the European Parliament, Lagarde said the ECB remained determined to bring inflation to its medium-term target rate of 2% “in a timely manner”.

Turkey’s central bank hiked its key interest by 5 percentage points to 30%.

The bank said it has kept up the monetary tightening process to rein in runaway inflation and control price instability.

Inflation in the country reached 58.94% in August. Inflation is expected to hit 65% at the end of 2023.

Thai Prime Minister Srettha Thavisin welcomed the first Chinese tourists landing in Bangkok on Monday, the first day of a new visa-free scheme that aims to boost the country’s tourism industry.

The Thai government has approved a visa waiver programme for Chinese visitors, which runs between September 25 and the end of February next year.

The first batch of Chinese visitors were welcomed with flowers and traditional Thai dance performance.

Speaking to the media at the airport, Srettha said this policy would greatly boost the economy.

Australian inflation rose 5.2% in the 12 months to August, up from a rise of 4.9% in July, data from the Australian Bureau of Statistics showed on Wednesday.

The rise was led by price increases in housing, transport as well as insurance and financial services.

Energy prices rose 12.7% in August year on year but fell 1.3% from those of July. Gas prices rose 12.9%, down from July’s increase of 13.9%.

Inflation excluding volatile items and holiday travel, rose 5.5% in August, down from 5.8% in July.

Japan’s Prime Minister Fumio Kishida unveiled a new economic stimulus package which aims to reduce the impact of inflation on households and raise wages.

The package will include measures to protect people from the impact of rising prices, spur sustainable wage and income gains, boost domestic investment to spur growth and reform to combat an aging society.

Boosting investment in semiconductors, batteries and biotechnology will be a focal point of the plan, according to Nikkei.