HOME>NEWS CENTER>Newsletters

IFF Newsletter Issue 63

TIME:2023-02-16

From the Editor

Inflation in the US and UK eased in January. Japan named academic economist Kazuo Ueda as the next governor of its central bank. The European Commission said the EU is to narrowly avoid recession this year. And World Bank President David Malpass is to step down by the end of June.

The IFF continues to bring you the latest China news and global development.

Theme:Finance and Insurance Serve the High Quality Economic Development of the GBA

Keynote Speaker: ZHOU Yanli, IFF Vice-president and former vice Chairman of the former CIRC

Time: February 24, 2023

To register: https://www.bagevent.com/event/8405985

Theme: One-on-One Global Dialogue on Global Economic Outlook: Challenges and Policy Priorities with IMF

Keynote Speaker: Krishna Srinivasan, Director, Asia and Pacific Department, the IMF

Moderator: Lin Jianhai, Vice President and Chairman of Global Center of the IFF

To register: https://www.bagevent.com/event/8406380

China tightened risk management requirements on commercial banks on Saturday, asking banks to classify assets beyond the currently required loans.

Starting from July 1, commercial banks are required to classify all financial assets including loans, bonds and off-balance-sheet assets into five categories ranging from normal to loss according to measures published by the People’s Bank of China and the China Banking and Insurance Regulatory Commission (CBIRC).

The rules are to help commercial banks accurately assess their asset risks and truthfully reflect the quality of their financial assets, said the CBIRC.

The new rules were issued as the existing classification rules have turned inadequate and commercial banks’ assets went through quite a lot of structural changes and risk classification faced many a new situation and problem.

The new rules were issued to reflect best practices in and outside of China and under the guidance of problem assets published by the Basel Committee on Banking Supervision in 2017.

China’s gas consumption dropped 1.7% in 2022, the first fall in two decades, Chinese media Caijing reported citing data from the National Development and Reform Commission (NDRC).

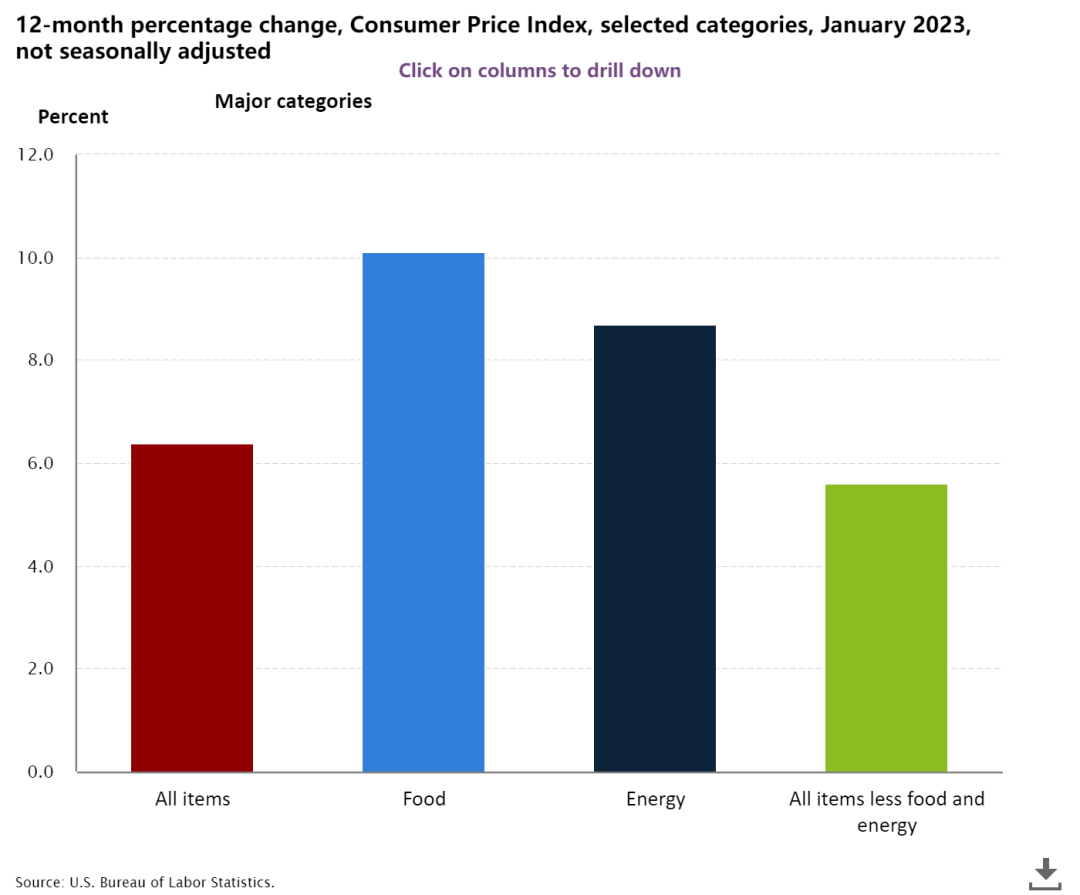

US inflation eased in January data released by the Bureau of Labour Statistics showed on Tuesday.

The Consumer Price Index (CPI) increased 6.4% in the 12 months to January, down from December’s annual rate of 6.5%.

Prices rose 0.5% on a monthly basis.

Core inflation, which excludes volatile food and energy prices, grew 5.6% over the last 12 months.

The prices for shelter accounted for nearly half of the price increase.

The European Commission lifted its growth forecast for the EU and the euro area to 0.8% and 0.9% in 2023, according to its Winter interim Forecast published on Monday.

The EU will narrowly avoid recession according to the forecast.

EU economies continue to face strong headwinds including high energy costs and rising inflation.

Inflation in the euro area is projected to fall to 8.5% in January, driven down by by falling energy inflation.

The European Commission publishes two comprehensive forecasts (spring and autumn) and two interim forecasts (winter and summer) each year.

Officials from European Union met in Burssels on Wednesday to discuss new sanctions against Russia, which could cost 11 billion euros in lost trade, Reuters reported.

The EU is expected to have new sanctions against Russia to mark the one-year anniversary of the Russia-Ukraine conflict.

World Bank President David Malpass said on Wednesday he will step down by the end of June.

His five tenure was due to end in April 2024.

“This is an opportunity for a smooth leadership transition as the Bank Group works to meet increasing global challenges, facilitate private investment, sharpen its focus on global public goods, and maintain strong momentum on operational delivery and portfolio performance for client countries,” said Maplass in press release by the World Bank.

Maplass gave no specific reason for his early departure but has faced calls for his resignation last autumn when he refused to answer whether he believed in the scientific consensus around climate change.