China released August data on inflation, new bank loans and auto sales in the past week. China’s auto sales particularly NEV sales surged while consumer and producer inflation slowed last month. New bank loans rose by 1.25 trillion yuan in August, missing expectation. In a reform meeting, Chinese President Xi Jinping has called for breakthroughs in core technologies.

US inflation remained stubbornly high in August while soaring energy bills continue to haunt Europe. The European Central Bank on Thursday raised key interest rates by record margins to combat runaway inflation. President Biden has signed an executive order on Monday to boost biomanufacturing in a bid to reduce reliance on foreign countries.

The IFF continues to bring you the latest China news and global development.

Innovation and globalization to spearhead Asia’s growth despite challenges

Innovation and globalization will continue to drive Asian growth in the coming years despite challenges such as the COVID-19 pandemic and current recession, panelists said on Thursday at the 24th Academic Seminar of the International Finance Forum (IFF).

Asia, which has seen phenomenal growth in the past 50 years, has benefited from pragmatic policies and approaches of many Asian governments, said Takehiko Nakao, Chairman of the Mizuho Research Institute and former President of the Asian Development Bank (ADB).

The seminar commenced with Nakao’s introduction of his memoir “The Rise of Asia: Perspectives and Beyond” (published in July 2022 and available at ADB’s website), in which he looked back at his tenure at the Asian Development Bank between 2013 and 2020.

The IFF also invited renowned economists to discuss current challenges and opportunities in Asia. The panelists included Professor Justin Yifu Lin from Peking University, Daniel Runde, Senior Vice President of the Center of Strategic and International Studies (CSIS), and Hoe Ee Khor, Chief Economist of ASEAN+3 Macroeconomic Research Office (AMRO Asia).

Industrialization, technological development, demographic dividend and globalization have been the driving forces of Asia’s rise, said Nakao.

“There is no such thing as Asia Consensus,” said Nakao, “But effective policies, strong institutions, governments’ decisiveness in introducing reforms, an ability to learn, and a clear vision for the future often championed by forward-looking leaders, mattered.”

Justin Lin from Peking University said standard economic theories such as the Washington Consensus failed to differentiate between developed economies and emerging markets.

“It is important to have an Asian voice in the global community,” Lin said.

Asia’s dynamic growth in the past decades and growing proportion in the global GDP to 24% from 4.1% in the past 50 years, best explains the region’s success, said Lin.

The panel also agreed on the important role the government played in the innovation-driven development of Asia, in promoting education, deployment of investment, protecting intellectual property and the private sector.

China consumer and producer inflation slow in August

China’s consumer price index (CPI) rose 2.5% from a year earlier in August, down from July’s 2.7% while the producer price index (PPI) increased 2.3%, slower than July’s 4.2%, according to data released by the National Bureau of Statistics on Friday.

Food prices grew by 6.1% in August, down from July’s 6.3% and non-food prices rose 1.7% versus July’s 1.9%.

Core CPI, excluding food and energy prices, rose 0.8%, same as that of July.

The PPI and purchasing price of industrial products slumped in August, down by 1.2% and 1.4% from the previous month respectively.

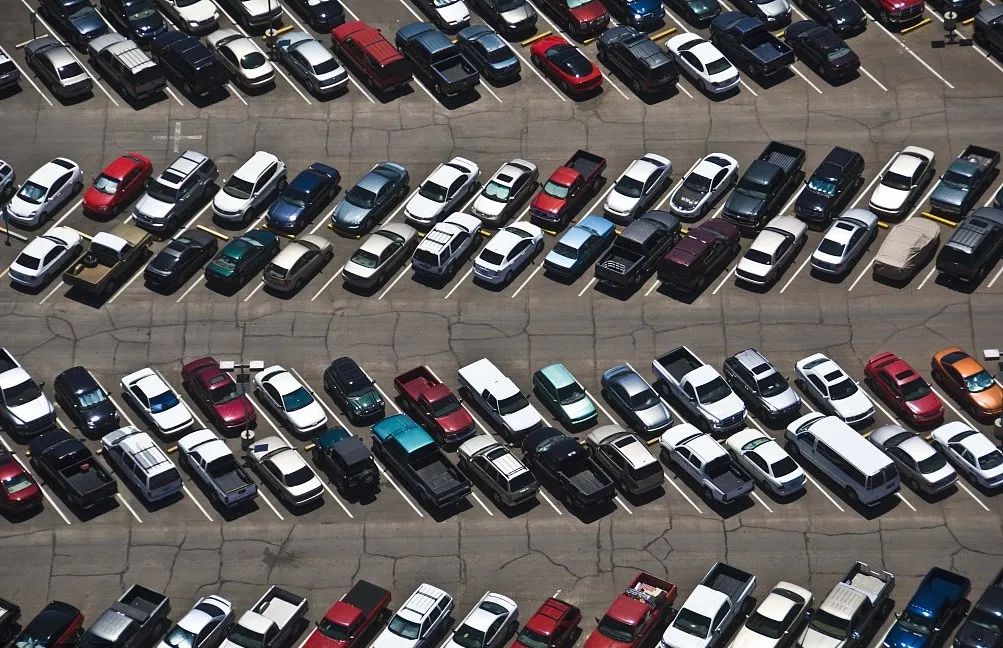

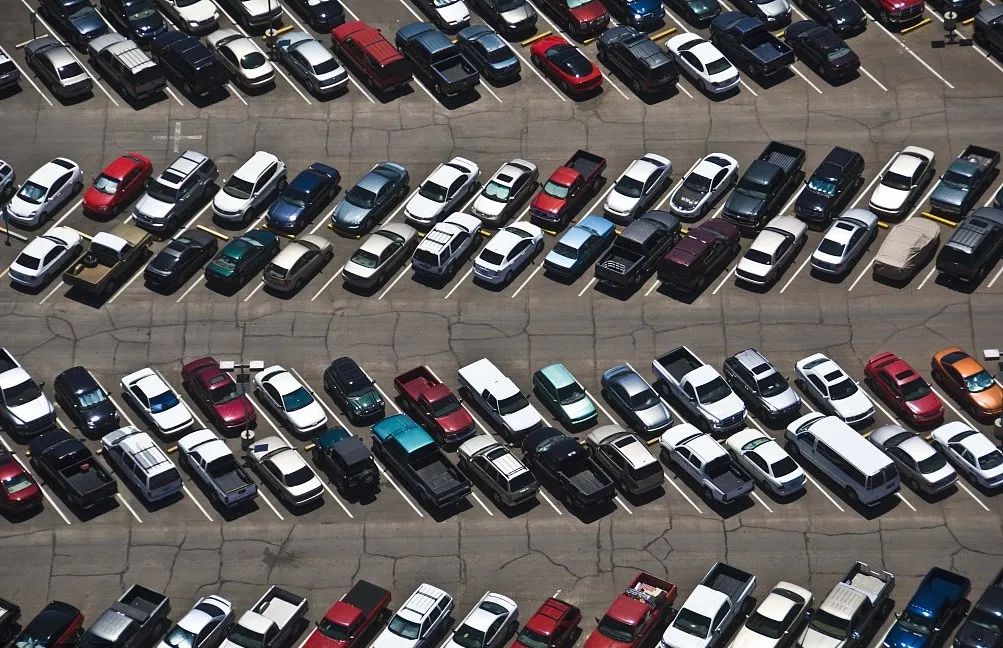

China’s August auto sales surge by 32%

China’s car sales reached 2.38million in August, rising 32.1% year on year, led by strong growth in new energy vehicles, industrial data showed on Friday.

NEV, including electric vehicles, plug-in hybrids and hydrogen fuel-cell vehicles, grew by 100% from the previous year, according to data from the China Association of Automobile Manufacturers.

Auto sales in the first eight months rose 1.7% from the same period last year.

China’s August new bank loans rise by 1.25 trillion yuan

New loans denominated in yuan increased by 1.25 trillion yuan in August, data from China’s central bank showed on Friday.

Outstanding yuan loans grew by 10.9% in August, according to data released by the People’s Bank of China.

The M2, a broad measure of money supply that covers cash in circulation and all deposits, stood at 259.51 trillion yuan by the end of August, up by 12.2% year on year.

Xi urges the nation to mobilise for core technology breakthrough

Chinese President Xi Jinping urged the nation to mobilise to make breakthroughs in core technologies to overcome obstacles in development and gain competitive edge in key fields, according to Chinese media reports.

Xi made the remark during a meeting of the Central Commission for Comprehensively Deepening Reform last Tuesday.

He stressed the need to focus on the nation's strategic demand in the scientific sector, optimize the allocation of resources for technological innovation, enhance the nation's strategic forces in science and technology and significantly raise the country's capacity for overcoming difficulties in technological progress, according to China Daily.

China's central bank calls for increasing use of digital yuan

China’s central bank on Thursday urged more efforts to make it easier for customers to switch between the digital yuan and electronic payment to increase the use of the digital currency.

Fan Yifei, deputy governor of the People’s Bank of China, said that more efforts should be made to expand the scenarios and environment for the use of the digital yuan, Xinhua News Agency reported.

China lists 19 systemically important banks

China unveiled a list of 19 systemically important banks for 2022 to “strengthen supervision” of the banking system, according to a statement by the People’s Bank of China on Friday.

The list includes six state-owned commercial banks, nine joint-stock commercial banks and four city commercial banks.

The list was jointly unveiled by the People’s Bank of China and the China Banking and Insurance Regulatory Commission.

42 Chinese companies delisted this year, regulator

China Securities Regulatory Commission has asked 42 companies to stop selling stocks this year to have quality stocks in the market.

More than 900 financial institutions have been deregistered by the first half of the year to reduce risks, the CSRC said in a statement on Saturday.

Shanghai bourse to establish green industry subindexes

The Shanghai Stock Exchange is to launch indexes to track the photovoltaic and solar industry starting from October 11, the Exchange announced on Friday.

The photovoltaic industry subindex will be composed of 30 securities and the solar subindex securities.

US outlines scope of Asian economic pact

The first round of in-person meetings for a US-led trade framework with more than a dozen Asia-Pacific nations concluded on Friday.

Officials from 14 nations, including the US, Japan, India, South Korea, Singapore, Australia and New Zealand met in Los Angeles on Thursday and Friday to negotiate on the Indo-Pacific Economic Framework.

US Secretary of Commerce Gina Raimondo and Trade Representative Katherine Tai hosted the meeting.

The 14 countries reached consensus on ministerial statements on trade, supply chains, clean economy and fair economy, according to a statement by the US Embassy in Singapore.

US August inflation rises more than expected

US inflation remained high in August despite drop in gas prices, data by the US Bureau of Labour Statistics showed on Tuesday.

The Consumer Price Index in August rose 8.3% from a year earlier, down from 8.5% in July. The drop was driven by lower gas prices.

The costs of housing, food and medical care continued to surge in August.

Core inflation, prices excluding food and energy, jumped 6.3% in August.

Biden signs order to boost bio-manufacturing

US President Joe Biden on Monday signed an executive order to boost biotech production in the US, according to a statement by the White House.

President Biden signed the order to launch a National Biotechnology and Biomanufacturing Initiative to “create jobs at home, build stronger supply chains, and lower prices for American families,” the statement said.

The White House will host a summit on the initiative on Wednesday, announcing new investments and resources.

The initiative aims to boost biomanufacturing in pharmaceuticals as well as health, agriculture and energy sectors, according to the statement.

European Central Bank sets record interest rates hike

The European Central Bank on Thursday raised interest rates by a record margin to fight soaring inflation.

The Governing Council of the ECB raised its three benchmark interest rates by 75 basis points to “ensure the timely return of inflation to the ECB’s 2% medium-term target”, the ECB said in a statement.

Inflation in the Eurozone reached 9.1% in August, according to Eurostat estimate.

The ECB promised more rate hikes “to dampen demand and guard against the risk of a persistent upward shift in inflation expectations”.

EU energy ministers urge measures to tame energy prices

Energy ministers of the EU member countries on Friday urged the European Commission to take measures to tame rising energy bills.

The majority of the EU member states have urged the EU to adopt a price cap on all gas imports.

EU energy ministers met in an emergency meeting in a bid to tame rising electricity prices.

The ministers agreed on power savings targets during peak hours and new levies on excess revenues, according to media reports.

Global shipping rates continue to fall

Shipping rates continue to fall as trade volumes slow according to data from S&P Global Market Intelligence, CNBC reported.

Reduced port congestion along with weaker cargo arrivals contributed to the decrease in freight rates, according to S&P’s research note.

Shipping traffic, which was severely congested during the pandemic, has been clearing up as supply chain disruption eases.

“Based on expectation of weaker trade volume, we do not expect extremely high congestion again in the coming quarters,” said S&P in a note.

国际金融论坛

国际金融论坛(IFF)是非营利、非官方独立国际组织,2003年10月由中国、美国、欧盟等G20国家,及联合国、世行、IMF等国际组织及领导人共同发起成立,是全球金融领域高级别常设对话机制和多边合作机构,被誉为金融领域的“F20”。