HOME>NEWS CENTER>Press Releases

The 16th Global Carbon Pricing Conference on green global energy puts China, EU, US in the spotlight

AUTHOR:IFF

FROM:IFF

TIME:2024-07-24

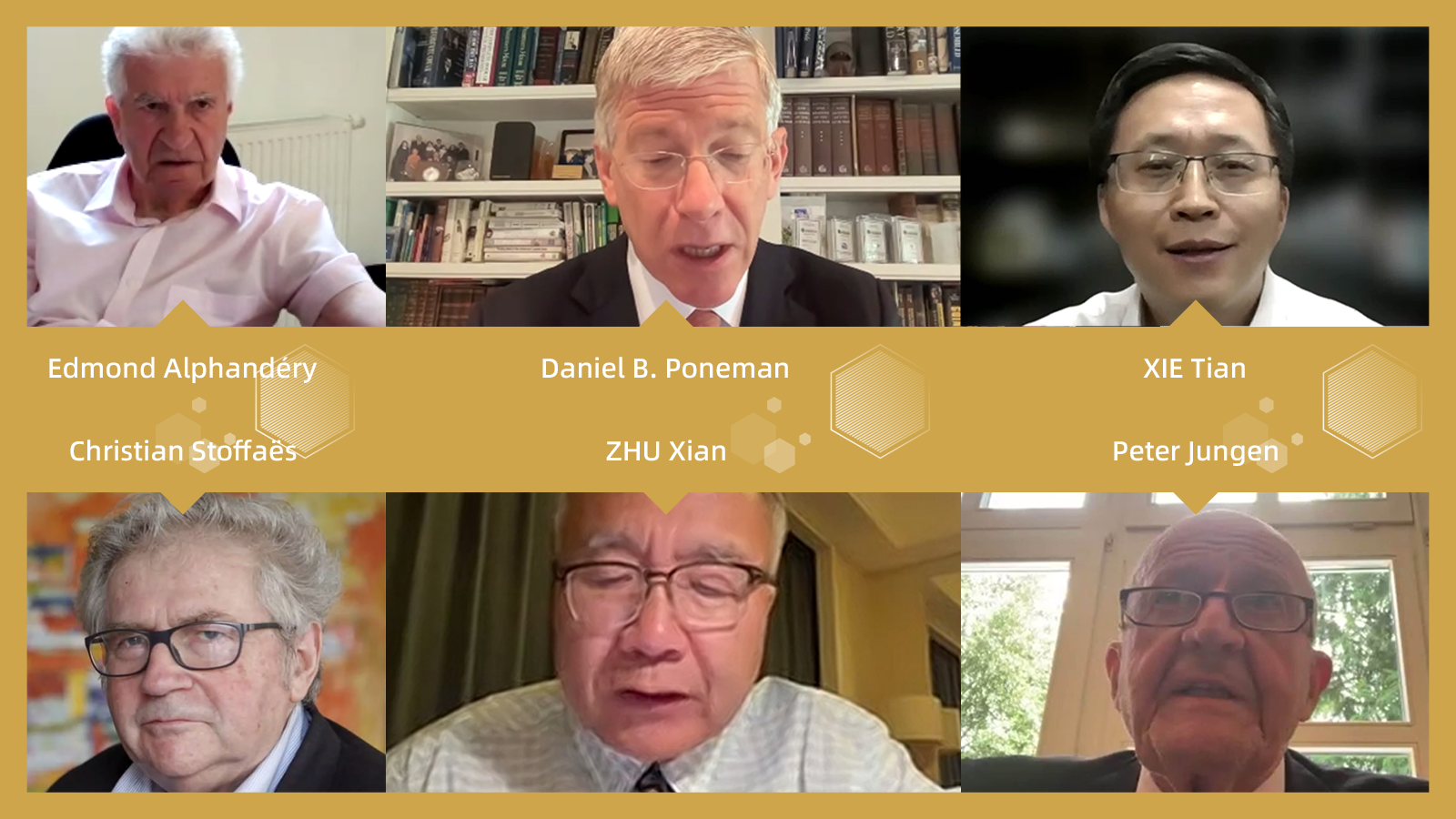

The International Finance Forum (IFF), the Task Force on Carbon Pricing in Europe, and the US-based Paulson Institute held an online symposium on 23rd July on the current state of production of renewables and nuclear energy - the two most promising sources to achieve carbon-neutrality, and whose production can rise at the right pace - ways to foster their development, and obstacles to this, with a focus on the price of carbon, and the right path going forward.

This three-hour exchange was lent a sense of urgency by the revelation that the global mean temperature from February 2023 to January 2024 was the highest ever: 1.52°C above the 1850-1900 period, per the Copernicus Climate Change Service, and the 1.5°C threshold agreed at the Paris COP21 United Nations Climate Change Conference has likely already been reached, while greenhouse gas emissions keep growing each year.

Each of these two energy sources had its own dedicated session at this three-hour forum conducted via Zoom, starting with renewables. The global responsibility of the three main economic blocs of the United States, China, and Europe - ideally acting in concert - also came under the meeting’s lens.

After opening remarks by Zhu Xian, IFF Executive Vice President and Former Vice President of the World Bank, and Edmond Alphandéry, Chairman of the Task Force on Carbon Pricing in Europe, the first session on renewables addressed their major successes in some countries - notably China - then cited the roadblocks to their development, such as, e.g., in Europe, where many firms have scaled back projects due to low electricity prices and high interest rates. The price of carbon holds part of the solution here, the participants agreed.

The second session on nuclear power addressed its growing momentum in the world. In the COP28 in Dubai, more than 20 countries, among them the US, the UK and France, agreed to try to triple global nuclear power capacity by 2050.

Heymi Bihar, Senior Analyst with the International Energy Agency, kicked off the first phase. China made two-thirds of global investment in renewables in 2023, he noted.

Nicholas Piau, founding partner and Chief Executive Officer of TiLT Capital, cited the energy trilemma of energy security, energy sustainability, and energy affordability, and predicted the high cost of developing renewables will trigger a backlash in Europe. He foresees technological advances increasing windmills’ capacity, thus obviating the need for costly new installations by “flexibilizing” legacy assets.

Tian Xie, General Manager of the Strategic Management Center of China’s LONGi Green Energy Technology, expounded on how green power + hydrogen power will contribute to green growth, and said China is developing its hydrogen technology with a view to exporting it. He forecast that photovoltaic costs will decrease the fastest among all renewables, and predicted China’s carbon emissions will peak in 2028.

Damien Ma, Managing Director of the MacroPolo think tank at the Paulson Institute, asserted that manufacturing and mining are critical to the energy transition, and noted that USD1 in public investment has spawned USD5 in private investment in batteries, and solar and wind energy. China has 70-80 percent of rare earth processing and thus the US, which is virtually devoid of its own rare earth deposits, lacks infrastructure to process its few resources, and so China, which holds the lion’s share of rare earths, would have to process US output any case, and nuclear is therefore the way forward for US, he argued, with 50 percent of the country’s power already coming from nuclear sources. Ma cited the politics of energy as a huge problem in US and international energy policy. The US currently aims for 100 percent of its power to come from clean sources by 2035, he added, but the results of the November presidential election may well upset this goal.

Jacek Rostowski, former Deputy Prime Minister of Poland, observed that Poland’s coal consumption now represents less than 50 percent of its energy supply, that renewables are cheaper, and coal prices are rising. Poles are aware, too, that coal reliance is anti-competitive. The country is pushing for land-based windmills, since offshore installations in the Baltic Sea are just too expensive. Poland’s transition away from coal is thus eminently feasible, in Rostowski’s view, and this problem can be resolved in five to 10 years.

The second session, which was devoted to the resurgence of nuclear power after a lengthy lull, then began.

This segment started with a presentation by Malwina Qvist, Nuclear Program Lead at the Clean Air Task Force. She explained that nuclear power fuel is dense, produces little waste, and can help to decarbonize hard-to-abate sectors. This resource grew quickly in in the 1960s, 1970s, and 1980s, she stated, then stagnated following the disasters at Three-Mile Island and Chernobyl. Of the 440 reactors operating in the world, most are in the US, Europe, and Asia - China, Japan, India - Qvist noted. The US has the most with 94. China is set to overtake it, however, with 56 now running and 28 in preparation, and more planned. The desire for energy security is driving this worldwide nuclear scale-up. Participants at Dubai agreed to triple nuclear by 2050 to deliver 20 percent of global energy. Hurdles are a lack of access to sustainable funds, reliability and dispatchability being not valued, and diverse, incompatible regulation hindering tech transfers. Costs are high because of construction amnesia from the decades-long hiatus in new construction, high interest costs, and lack of access to funding for nuclear projects. Commoditization, new markets, and improved competitiveness are the answers to further developing nuclear energy, she stated.

Prof Sheng Zhou of the Institute of Energy, Environment and Economy at China’s Tsinghua University, said that, by 2025, China will have 70 gigawatts of nuclear power in operation and 40GW under construction. The country’s carbon peak target before 2030 will be for 25 percent non-fossil fuel energy, and China will make nearly USD1 trillion in investment in alternatives by 2050. Steelmaking with hydrogen is one means Zhou also cited for achieving China’s ambitious targets.

Daniel Poneman, former US Deputy Secretary of Energy and ex-President and Chief Executive of Centrus Energy, stated that smaller nuclear plants represent the way forward, though nuclear is already less size-intensive than solar or wind power. He cited a generational divide in support for nuclear power, with youngsters more receptive than those of his own Boomer generation. He lamented the loss of supply chain from the US’ 30-year hiatus on nuclear construction, and the “steep learning curve” to recovery.

Philippe Varin, Chair of the International Chamber of Commerce, agreed that small modular reactors are the answer to many of the issues associated with nuclear energy.

Franz Nauschnigg, former head of European affairs and the international financial organizations division at the Österreichische Nationalbank and member of the board of the European Task Force on Carbon Pricing, remarked on the irony that, after Germany shut down its own nuclear reactors, it now imports nuclear power from France, since its grid is insufficiently strong to transport energy from the country’s northern offshore windfarms.

Alphandéry closed the meeting, commending all the speakers for their passion, particularly in the nuclear energy segment.