HOME>NEWS CENTER>Newsletters

IFF Newsletter | Bond Sales Of China’s Local Gov’ts Surge in Aug

TIME:2024-09-05

From the Editor

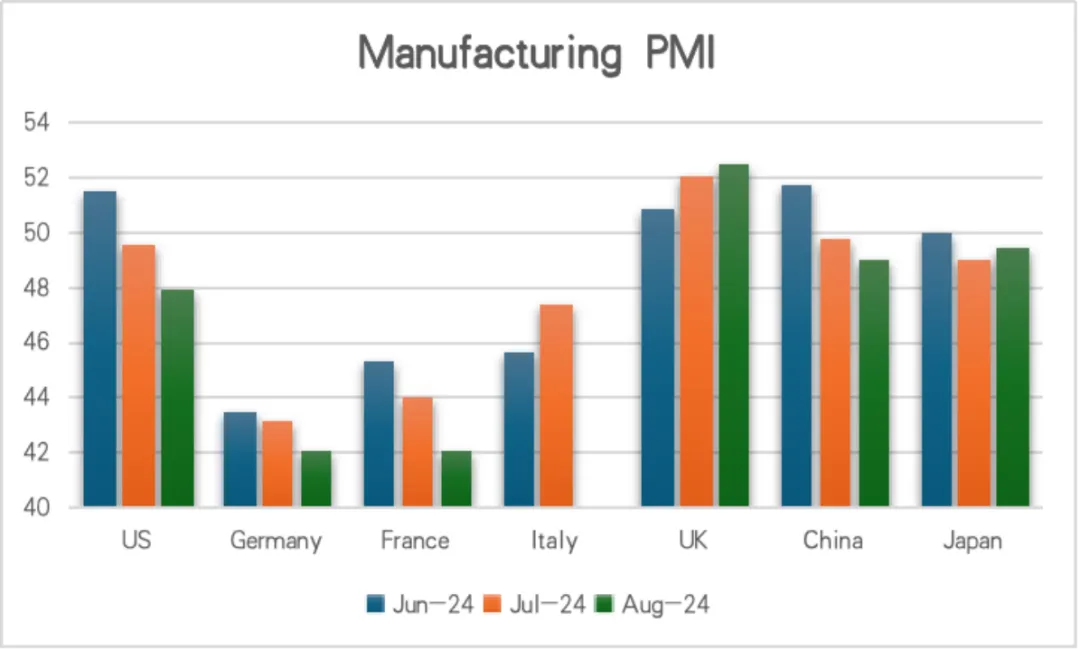

IFF Institute Releases Analysis of Macroeconomic Data from Major Developed Economies

【IFF Live】Crossing Borders: The Evolution of the International Landscape Amidst the Receding Tide of Globalization

From August 28th to September 4th, the IFF Live Streaming Room hosted three live events focusing on hot topics such as corporate governance, the new global economic landscape, and population trends.

China’s Local Gov’ts Crank Up Bond Sales in August to Fuel Economic Growth

Shanghai to Offer Record USD562 Million Subsidies for Trade-In of Consumer Goods

China announces probes over Canada's tariff hike, certain products

China's int'l trade in goods, services up 12 pct in July

China Rolls Out New Measures to Spur Private Investment as Growth Stalls

China’s Factory Activity Falls to Lowest in August Since February, NBS Data Shows

Newsletter

International News

Japan Firms' April-June Pretax Profits Hit Record, Investment up 7.4%