HOME>NEWS CENTER>Newsletters

IFF Newsletter | China Has Record First-Quarter Trade

TIME:2025-04-18

From the Editor

The recently released economic data shows that China's economy got off to a smooth start in the first quarter. Less than a week after the announcement that the decline in the Consumer Price Index (CPI) narrowed in March, China's National Bureau of Statistics released on April 16 another set of economic data with good performance, including the GDP figure for the first quarter.

In the first quarter of this year, China's GDP grew by 5.4 percent, exceeding the 5.3 percent growth in the same period last year. Retail sales of consumer goods in March increased by 5.9 percent, surpassing the 4 percent growth in January and February.

U.S. Federal Reserve Chair Jerome Powell again stressed on April 17 the central bank must ensure tariffs don’t trigger a more persistent rise in inflation.

Powell said policymakers would balance their dual responsibilities of fostering maximum employment and stable prices, “keeping in mind that, without price stability, we cannot achieve the long periods of strong labor market conditions that benefit all Americans.”

On April 13, the International Finance Forum (IFF) launched its Sci-tech Finance Committee in collaboration with the Wuhan Industrial Innovation Development Research Institute (WHIIID) and held the first Sci-tech Finance Roundtable at WHIIID in Wuhan.

Amid growing global economic divergence and geopolitical uncertainty, the event gathered leaders from government, industry, academia, and finance to explore how to enhance the role of technology finance in supporting innovation and driving high-quality economic development. The establishment of the Sci-tech Finance Committee aims to create a platform for the deep integration of technology and finance, bolstering the influence and competitiveness of tech finance both domestically and internationally.

The IFF's 20th Global Carbon Pricing Conference Tackles Climate Change in a New Geopolitical Era

On April 11, the International Finance Forum (IFF), in partnership with the Task Force on Carbon Pricing in Europe and the Institute for Governance & Sustainable Development (IGSD), successfully hosted the 20th Global Carbon Pricing Conference titled "The Fight Against Climate Change in the New Geopolitical Environment" as an online event.

The conference featured contributions from high-level personalities and brought together numerous experts from economics, environmental science, and financial investment. Participants discussed the current situation in the fight against climate change and began to explore various strategies to maintain momentum in addressing this critical issue.

China's GDP Expands 5.4 Pct Year on Year in Q1

China's economy demonstrated robust momentum in the first quarter of 2024, with GDP expanding 5.4 percent year-on-year to CNY31.9 trillion (USD4.4 trillion), outpacing the 5.3 percent growth recorded in the same period last year, according to data released by the National Bureau of Statistics (NBS) on April 16.

The strong performance was accompanied by improvements across multiple economic indicators. Large enterprises reported a 7.7 percent year-on-year increase in industrial added value, up from 5.9 percent in January-February..

Retail sales of consumer goods rose 5.9 percent in March, a step up from 4 percent in January-February. Fixed-asset investment climbed 4.2 percent, slightly above both the 4.1 percent growth in January-February.

China’s average surveyed urban unemployment rate stood at 5.3 percent in the three months, up slightly from 5.2 percent. Meanwhile, per capita disposable income rose 5.5 percent to CNY12,179 (USD1,662).

The Consumer Price Index (CPI) recorded a mild 0.1 percent year-on-year decline in March, narrowing from February's 0.7 percent drop,the NBS said earlier. For the entire quarter, consumer inflation remained subdued at -0.1 percent, while the Producer Price Index (PPI) fell 2.3 percent from a year earlier.

ASEAN+3 Region Is Prepared to Withstand Global Tariff Shocks, AMRO Says

The ASEAN+3 region, which consists of the 10 member states of the Association of Southeast Asian Nations and China, Japan, and South Korea, is resilient and has the policy means to withstand global trade shocks from the US "reciprocal tariffs", an international organization that contributes to the area's economic stability announced on April 15.

The ASEAN+3 region faces big challenges from new US tariffs. 13 of 14 member economies face some of the highest effective tariff rates set by former US President Donald Trump. The ASEAN+3 Macroeconomic Research Office (AMRO) in Singapore said the trade - weighted average tariff, excluding China, is about 26%.

AMRO noted that the tariffs and policy - shift uncertainties will likely weaken trade, disrupt supply chains, and increase financial market volatility.

Despite this, AMRO forecasts the ASEAN+3 economy will grow over 4% this year and next, driven by strong domestic demand, recovering investment, and stable low inflation. But the "reciprocal tariffs" bring much uncertainty, possibly cutting growth below 4% this year and to 3.4% in 2026.

At a recent ASEAN+3 meeting in Kuala Lumpur, Malaysia, officials made the yuan a funding currency under the Chiang Mai Initiative Multilateralization. People’s Bank of China Deputy Governor Xuan Changneng joined other finance and central bank deputies, showing a joint effort to boost regional economic stability.

China Has Record First-Quarter Trade

China's imports and exports rose 1.3 percent to CNY10.3 trillion in the first quarter of this year, setting a historic high for the period, which includes the Chinese New Year holiday, according to official data released on April 14.

China’s international trade topped CNY10 trillion for the eighth consecutive quarter in the three months ended March 31, the General Administration of Customs announced.

The country’s trade surplus reached CNY1.96 trillion, with CNY736.7 billion generated in March alone.

The increase was driven by rising exports, with a modest decline in imports. Exports totaled CNY6.13 trillion in the three-month period, up by 6.9 percent.

Quarterly imports dropped by 6 percent to CNY4.17 trillion. The decline was driven by fluctuating demand for certain commodities.

In US dollar terms, China’s international trade in the first quarter edged up 0.2 percent to USD1.43 trillion. Exports rose by 5.8 percent to USD854.7 billion, while imports declined by 7 percent to USD580.7 billion.

China’s Credit Growth Speeds Up in March

Credit and social financing growth accelerated in China last month, signaling a recovery in corporate and household demand, according to the data released on April 13 by the People’s Bank of China.

Yuan-denominated lending rose by CNY9.78 trillion (USD1.34 trillion) in the first quarter, swelling outstanding yuan loans to CNY265.41 trillion as of the end of March, a 7.4 percent increase from a year earlier.

Average interest rates on newly issued loans for businesses and homebuyers fell to 3.3 percent and 3.1 percent, respectively, down 45 and 60 basis points from a year earlier.

The balance of M2 -- a broad measure of money supply that covers cash in circulation and all deposits -- was CNY326.06 trillion (USD44.7 trillion) at the end of March, up 7 percent from a year ago.

Meanwhile, M1 -- a narrow gauge of money supply that covers circulating cash and non-bank and non-government deposits -- was CNY113.49 trillion, up 1.6 percent year on year and 1.5 percentage point higher month on month.

China Is Top Emerging Market in Kearney's FDI Confidence Index for Third Year in Row

China has topped the list of emerging markets in an annual survey of global business executives released on April 9 by US consulting firm Kearney Holdings that ranks markets likely to attract the most investment in the next three years.

In the world rankings of the Foreign Direct Investment Confidence Index, China slipped to sixth place from third, “likely reflecting the market's economic challenges, including an ongoing property crisis, alongside rising uncertainties in United States-China relations, particularly as they relate to trade,” Kearney said.

“Nevertheless, investors are buoyed by China's tech innovation, a sentiment perhaps boosted by the launch of popular artificial intelligence assistant by Chinese startup DeepSeek, and may reflect some optimism that China's USD1.4 trillion stimulus package announced in November 2024 could further boost economic performance,” Kearney added.

Kearney surveyed senior executives at world-leading corporations with annual revenues of more than USD500 million in January. Its findings were based on data from 536 respondents. When the survey was done, tariffs had not yet been hiked, and investors were still cautiously optimistic about the global business environment.

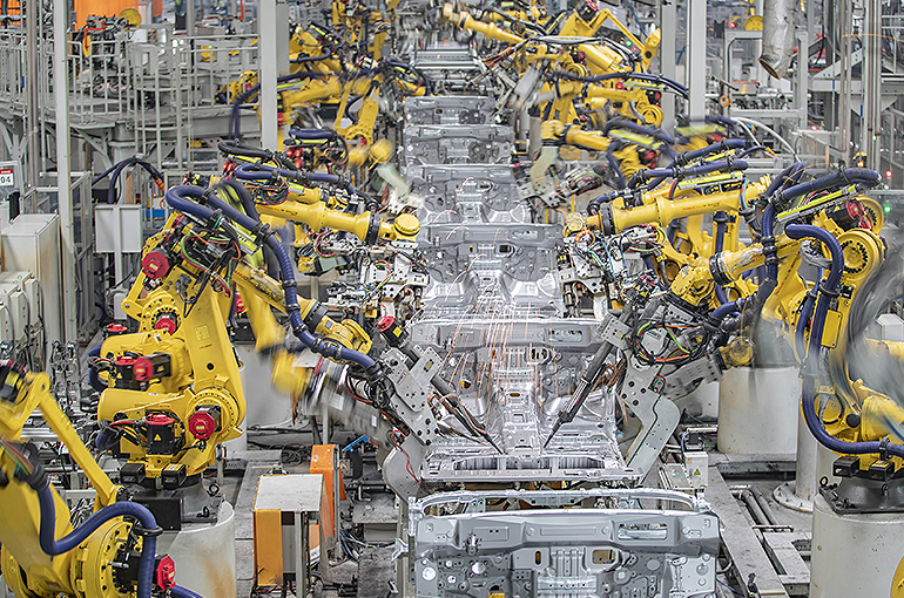

China’s March Retail Car Sales Climb at Fastest Pace in Nearly 10 Years on Policy Support

Retail sales of passenger vehicles in China surged over 14 percent last month from a year ago, marking the strongest year-on-year growth for March in almost a decade, fueled by government incentives encouraging vehicle trade-ins and upgrades, according to data released by the China Passenger Car Association on April 9.

Some 1.94 million passenger cars were sold in March, a 40 percent jump from the previous month.

The adoption rate of new energy vehicles continued to rise, exceeding 50 percent. Retail sales of NEVs exceeded 990,000 units, up 38 percent from a year earlier and 45 percent on February.

Newsletter

International News

Fed's Powell: Tariffs Must Not Spark Persistent Inflation, Vows to Maintain Price Stability

The Federal Reserve will ensure that tariff-driven price increases do not evolve into sustained inflation while maintaining its commitment to maximum employment, Federal Reserve Chair Jerome Powell emphasized in a speech at the Economic Club of Chicago on April 17.

"We must keep longer-term inflation expectations well anchored and prevent a one-time price level increase from becoming an ongoing inflation problem," Powell said, highlighting the central bank's key priority amid trade policy uncertainties.

The Fed chief stressed that price stability remains fundamental to achieving sustained labor market strength that benefits all Americans. This statement reinforces the Fed's cautious stance on its monetary policy path as it evaluates the economic impact of the current administration's trade measures.

The remarks align with Powell's recent communications, including his April 4 statement, suggesting that Fed officials are not rushing to modify the central bank's benchmark interest rate.

World Merchandise Trade Expected to Decline by 0.2 Pct in 2025 - WTO

The volume of global merchandise trade is expected to decline by 0.2 percent in 2025 under current tariff conditions, nearly 3 percentage points lower than the previous forecast based on a "low tariff" scenario, the World Trade Organization (WTO) said in its latest Global Trade Outlook and Statistics report released on April 16.

The WTO further warned of severe downside risks posed by the reinstatement of the U.S. "reciprocal tariffs" and spillover of trade policy uncertainty, which could lead to an even sharper decline of 1.5 percent in global goods trade in 2025.

North America is expected to see a "particularly steep" decline in goods trade, with exports forecast to drop by 12.6 percent, according to the WTO.

Meanwhile, Asia is expected to post modest trade growth, with exports and imports both forecast to grow by 1.6 percent. Europe is expected to register a 1.0 percent increase in exports and a 1.9 percent rise in imports.

The WTO said that services trade, which is not directly subject to tariffs, is also expected to be negatively affected. The volume of global services trade is forecast to grow by 4.0 percent in 2025, around 1 percentage point less than expected.

US Small Businesses File Lawsuit Against Trump's Tariffs

Multiple US small businesses on April 14 sued to challenge the White House's authority to unilaterally issue tariffs.

The lawsuit filed in the U.S. Court of International Trade argues that U.S. President Donald Trump's administration has no authority to issue across-the-board worldwide tariffs without congressional approval.

The lawsuit was jointly filed by the Liberty Justice Center, a nonprofit, nonpartisan and public-interest litigation firm, and Ilya Somin, a co-counsel and professor of law at George Mason University, according to a court document.

The lawsuit is filed on behalf of five owner-operated businesses from the states of New York, Pennsylvania, Utah, Virginia and Vermont.

OPEC Lowers 2025 Oil Demand Outlook Amid US Tariff Concerns

The Organization of the Petroleum Exporting Countries (OPEC) has revised down its forecast for global oil demand growth in 2025 to 1.3 million barrels per day (bpd), citing the expected impact of recently announced U.S. tariffs. The adjustment was outlined in OPEC's monthly oil market report released on April 14.

In the Organization for Economic Co-operation and Development (OECD) countries, oil demand has been revised downward and is now expected to increase by only around 40,000 bpd. Meanwhile, demand in non-OECD countries, also subject to a downward revision, is forecast to expand by almost 1.25 million bpd in 2025, the report said.

The organization also lowered its outlook for 2026, again attributing the adjustment to the projected impact of new U.S. tariffs. Global oil demand next year is now expected to rise by approximately 1.3 million bpd year-on-year.

Canadian, EU leaders Talk About Economic, Defense Cooperation

Canadian Prime Minister Mark Carney on April 10 spoke with President of the European Commission Ursula von der Leyen about economic and defense cooperation.

According to an information release issued by the prime minister's office, the leaders discussed the imposition of tariffs and ongoing threat of further unjustified global trade actions by the United States.

The leaders emphasized the importance of working together to deepen economic ties and promote economic security for people on both sides of the Atlantic.

Carney highlighted his plan to fight tariffs targeting Canada, including those on the auto, steel and aluminum industries.

US CPI Cools in March Year-on-Year, But Tariffs May Push Inflation Higher

US consumer inflation in March increased 2.4 percent from a year ago, after rising 3.0 percent in January and 2.8 percent in February, the US Labor Department reported on April 10.

Although inflation has been slowing down, analysts warn that the Trump administration's increased tariffs could drive prices up in the near future.

On a monthly basis, prices actually fell 0.1% in March, the first monthly drop in nearly five years, according to the report released by the Bureau of Labor Statistics, the Consumer Price Index (CPI), a broad measure of goods and services costs across the US economy.

The latest inflation report showed that the so-called core CPI, which excludes food and energy, grew 0.1 percent in March, following a 0.2 percent rise in February.

The core CPI rose 2.8 percent over the last 12 months ending March, down from a growth of 3.1 percent in February, signaling continuous inflationary pressure.